The MORPHO token

MORPHO is the Morpho Protocol's governance token. The governance system uses a weighted voting system in which the number of MORPHO tokens held determines voting power.

MORPHO holders can vote on changes or improvements to the protocol, see this section to get the exhaustive list of actions.

Legacy and Wrapped MORPHO

The original, now legacy, MORPHO token was deployed as an immutable contract and lacked functionality associated with onchain vote accounting. The governance voted to create a contract to wrap the legacy tokens into wrapped MORPHO to enable onchain vote tracking functionality in MIP-75.

In addition to onchain vote tracking, using an upgradeable token makes it possible to conform to a crosschain interoperability standard in the future, minimizing friction for MORPHO holders who want to move their tokens between chains.

Although legacy MORPHO tokens can be freely converted to wrapped MORPHO 1:1 via the wrapper contract, there could be a risk that legacy tokens might be used mistakenly in external integrations, such as exchanges. To prevent this, only the wrapped MORPHO will be transferable. Users can easily wrap their existing legacy MORPHO tokens on the Morpho App.

MORPHO Token Addresses

You can find MORPHO token contracts, related contracts addresses as well as Github repositories in the addresses section.

The MORPHO token has a maximum supply of 1,000,000,000 MORPHO.

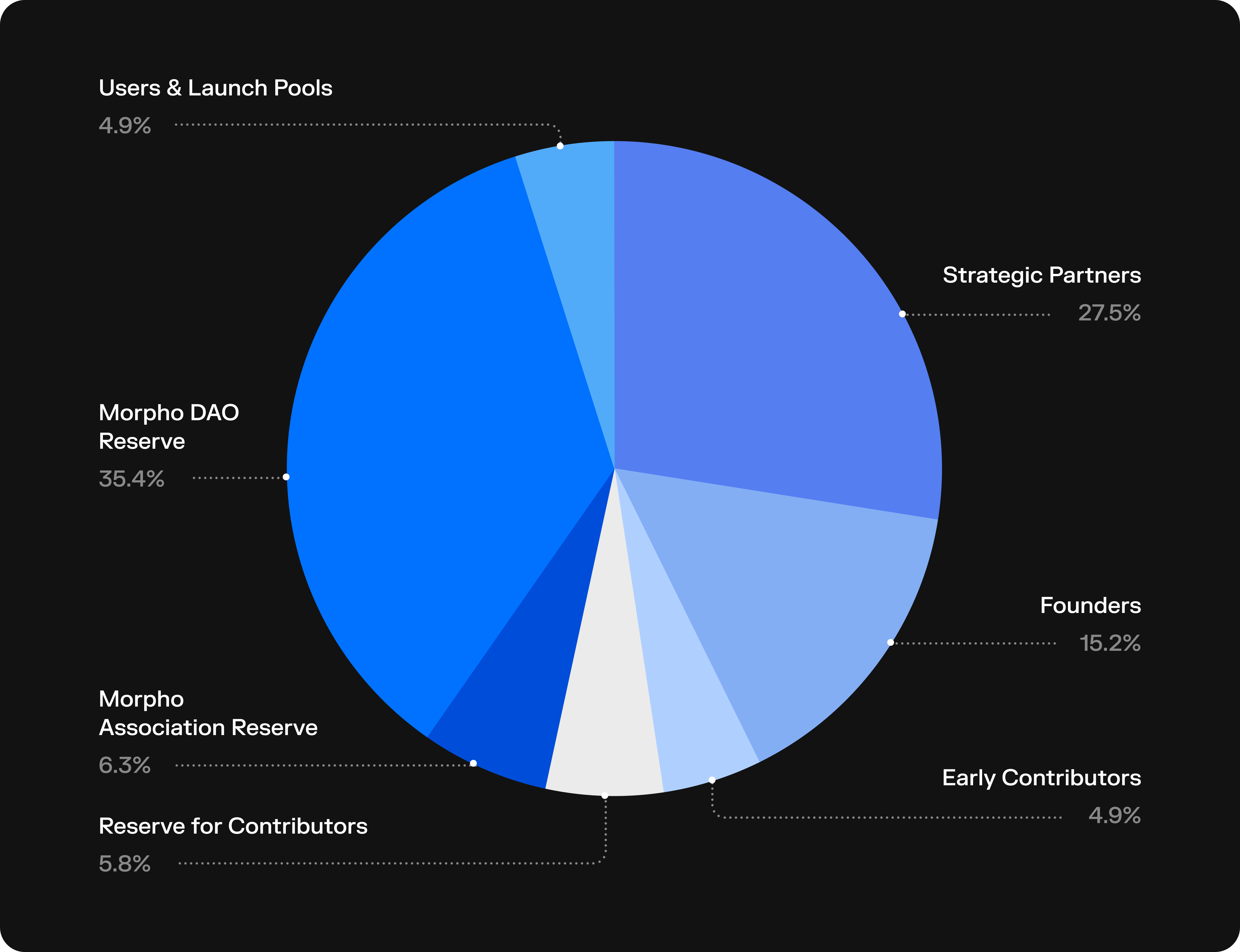

Token Distribution & Vesting

The overall distribution of MORPHO tokens, including vested and unvested allocations, as of 7 November 2024.

Morpho governance

35.4% of MORPHO tokens are owned and controlled by the Morpho governance. Holders of the MORPHO token can vote on how these tokens are used.

Users & Launch Pools

4.9% of MORPHO tokens have been distributed from the Morpho governance to users of the Morpho Protocol and launch pool participants. The Morpho governance continues to distribute MORPHO token as rewards.

Morpho Association

6.3% of MORPHO tokens are allocated to the Morpho Association for ecosystem development. This allocation can be used to fund partnerships, contributors, and any other initiatives that help grow the Morpho Protocol and advance Morpho’s network.

Reserve for Contributors

5.8% of MORPHO tokens are reserved for contributors to the Morpho Protocol for their role in the development and growth of the network. This reserve includes unallocated tokens set aside by the Morpho governance for future contributors to the Morpho Protocol such as Morpho Association employees, service providers, contractors, and research institutes.

Strategic Partners

27.5% of MORPHO tokens have been allocated to Strategic Partners tokens in exchange for providing support — monetary or otherwise — to the Morpho Protocol. These MORPHO tokens are distributed according to three vesting schedules based on the time these Strategic Partners joined the Morpho ecosystem.

Cohort 1: 4.0% allocated over a 3 year vest, with a 6 month lockup from when the MORPHO token contract was deployed on 24 June 2022.

Cohort 2: 16.8% originally allocated over a 3 year vest, with a 6 month lockup from 24 June 2022. However, these strategic partners have agreed to relock to a 6 month linear vesting, following a 6 month lockup from 3 October 2024. This means 100% is vested by 3 October 2025 at the latest.

Cohort 3: 6.7% allocated over 2 year linear vest, following a 1 year lockup from 21 November 2024. This means 100% is vested by 21 November 2027 at the latest.

Founders

15.2% of MORPHO tokens have been allocated to Morpho’s founders. The tokens were originally allocated over 3 year vest, with a 1-year lockup from when the token was deployed on 24 June 2022. However, all co-founders have agreed to relock to additional 2 year linear vest, following a 1 year lockup from the earliest of any future transferability date or May 17th 2025. This means 100% is vested by 17 May 2028 at the latest.

Early Contributors

4.9% of MORPHO tokens have been allocated to early contributors, including Morpho Association's contributors, independent researchers, and advisors, in exchange for contributions to the Morpho Protocol. These tokens have been subject to either:

- A 3-year vesting schedule with a 6-month lockup, or

- A 4-year vesting schedule with a 4-month lockup.

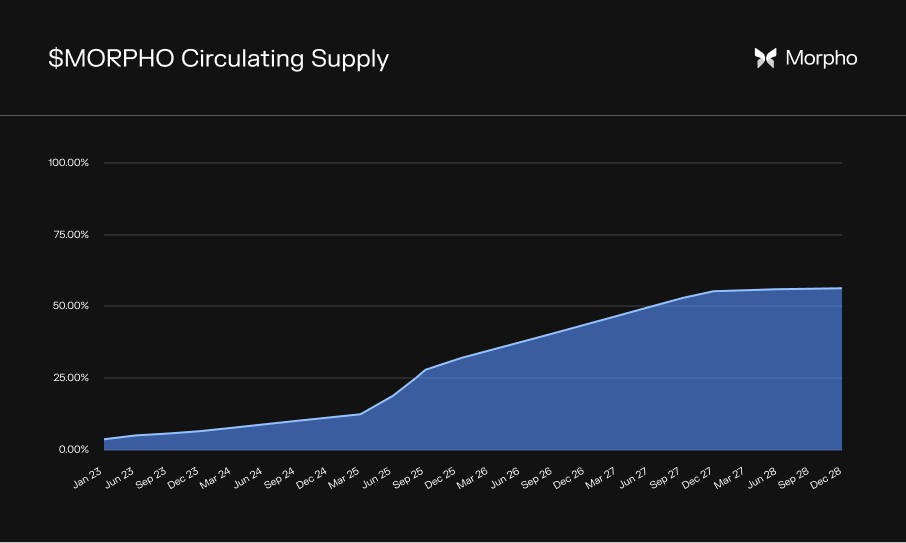

Circulating Supply

The circulating supply on transferability date is expected to be approximately 11.2%.

The chart below shows how the circulating supply of MORPHO tokens might evolve over time:

Note: the evolution of the MORPHO circulating supply over time is subject to change as the governance makes future decisions on use of reserves and rate of distributions.

Initial Non-Transferability Phase

While token-based governance allows anyone to own a share of the Morpho network, many token launches are very unfair because the launch date & price are often a centralized decision. Moreover, there is usually a large information asymmetry between the initial team/investors and the potential buyers.

The MORPHO token was launched as non-transferable to tackle those issues, allowing the governance to turn on transferability anytime. This enabled the protocol to reach meaningful traction prior to a decentralized token launch process.

Under this vision, a good equilibrium for the control of a governance is a clear distribution between:

- Users: To own a share of the network and to provide a positive feedback loop on the product.

- Contributors: To keep improving and building based on the user's feedback and on their technical vision.

- Strategic Partners: To provide capital and guidance to fuel those contributions.

The current state of distributions in categories 2. and 3. are described above. As for 1., it is described in the Rewards section.

Morpho governance Voted to Enable Token Transferability

Although initially deployed as a non-transferable token for the reasons mentioned above, the Morpho governance voted to enable the transferability of the MORPHO token to advance Morpho’s mission to make financial infrastructure a public good. Since launching in June 2022, the governance has progressively distributed ownership to the protocol’s users, strategic partners, risk curators, and other contributors aligned with Morpho's long-term vision. Now, by enabling token transferability, the Morpho governance is opening ownership of the Morpho network to anyone.

As discussed in the community forum, this move is a key step toward realizing the protocol’s mission of transforming financial infrastructure into a public good. It will empower a broader range of participants to engage with and contribute to the Morpho ecosystem, bringing new perspectives and ensuring that governance decisions reflect the interests of a more diverse community.

MORPHO token transferability was enabled on November 21, 2024.

FAQ

Why are there two MORPHO tokens? What’s the difference between them?

The original, now legacy, MORPHO token was deployed as an immutable contract and lacked functionality associated with onchain vote accounting. The Morpho governance voted to create a contract to wrap the legacy tokens into wrapped MORPHO to enable onchain vote tracking functionality in MIP-75.

In addition to onchain vote tracking, using an upgradeable token makes it possible to conform to a crosschain interoperability standard in the future, minimizing friction for MORPHO holders who want to move their tokens between chains.

Although legacy MORPHO tokens can be freely converted to wrapped MORPHO 1:1 via the wrapper contract, there could be a risk that legacy tokens might be used mistakenly in external integrations, such as exchanges. To prevent this, only the wrapped MORPHO is transferable. Users can easily wrap their existing legacy MORPHO tokens on the Morpho App (see How to wrap here).

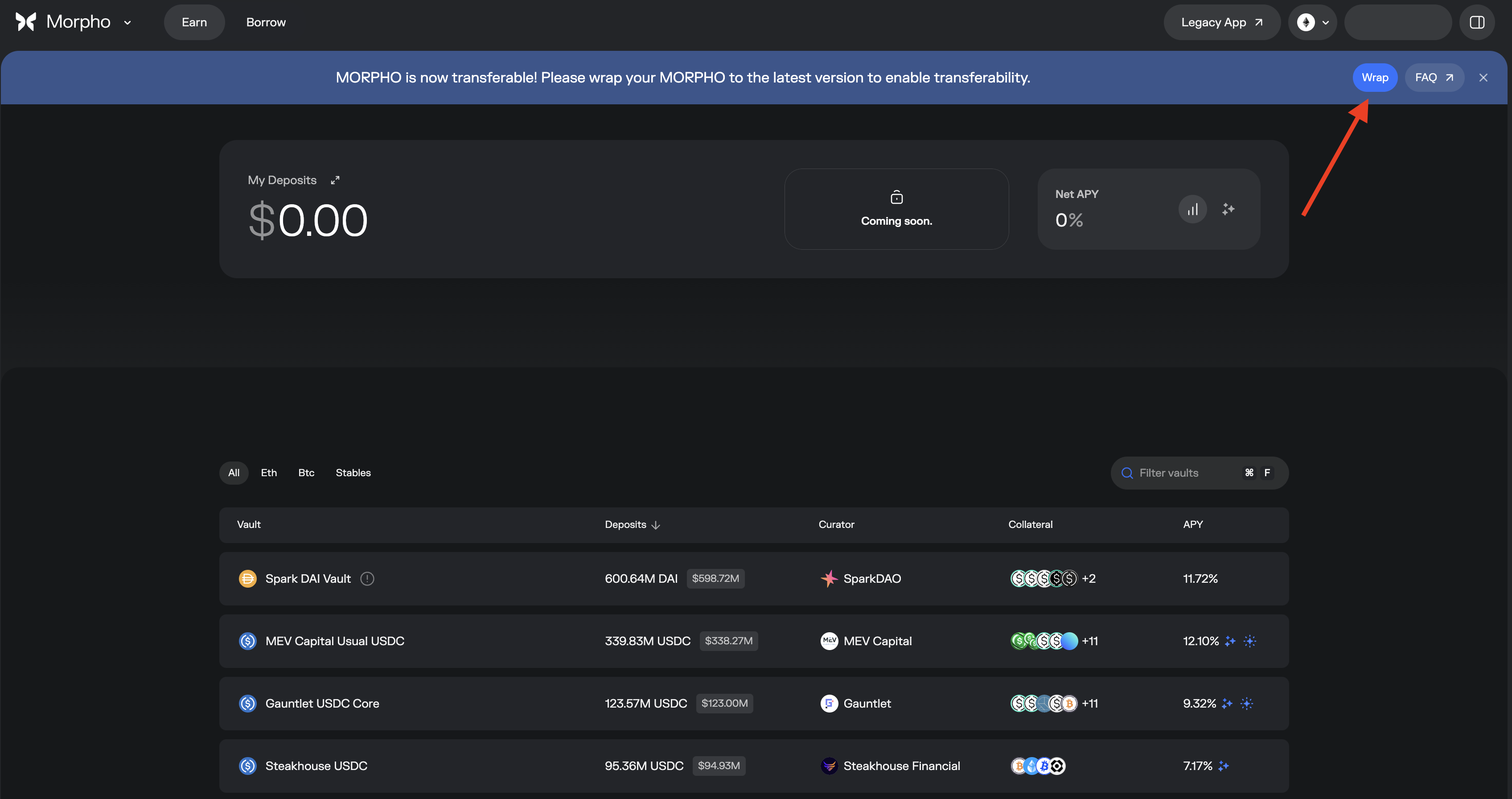

How to wrap the Legacy MORPHO token on the Morpho interface

If you hold Legacy MORPHO token, just go to app.morpho.org, connect your wallet holding the legacy tokens, and a banner will appear on top of the screen. This banner will allow you to migrate your Morpho Tokens.

Click on the Wrap button at the top right of the Morpho interface.

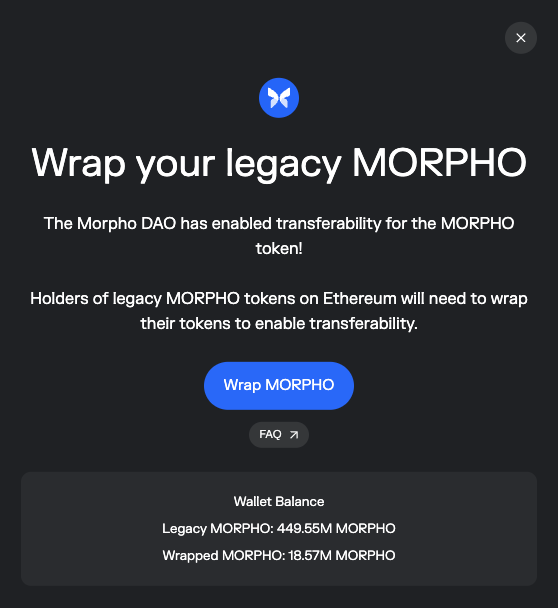

Clicking on the Wrap button will trigger a modal, showing your Legacy MORPHO token balance and proposing you to wrap it.

Then click on the Wrap MORPHO button and it will trigger:

- A transaction to approve the bundler to wrap the Legacy MORPHO tokens.

- A transaction to wrap the Legacy MORPHO tokens into the wrapped MORPHO token.

How to wrap the Legacy MORPHO token at contract level

If you hold Legacy MORPHO tokens and want to migrate them onchain by yourself without going through the Morpho app, you can directly interact at contract level, using Etherscan for instance.

To do so, you will have to:

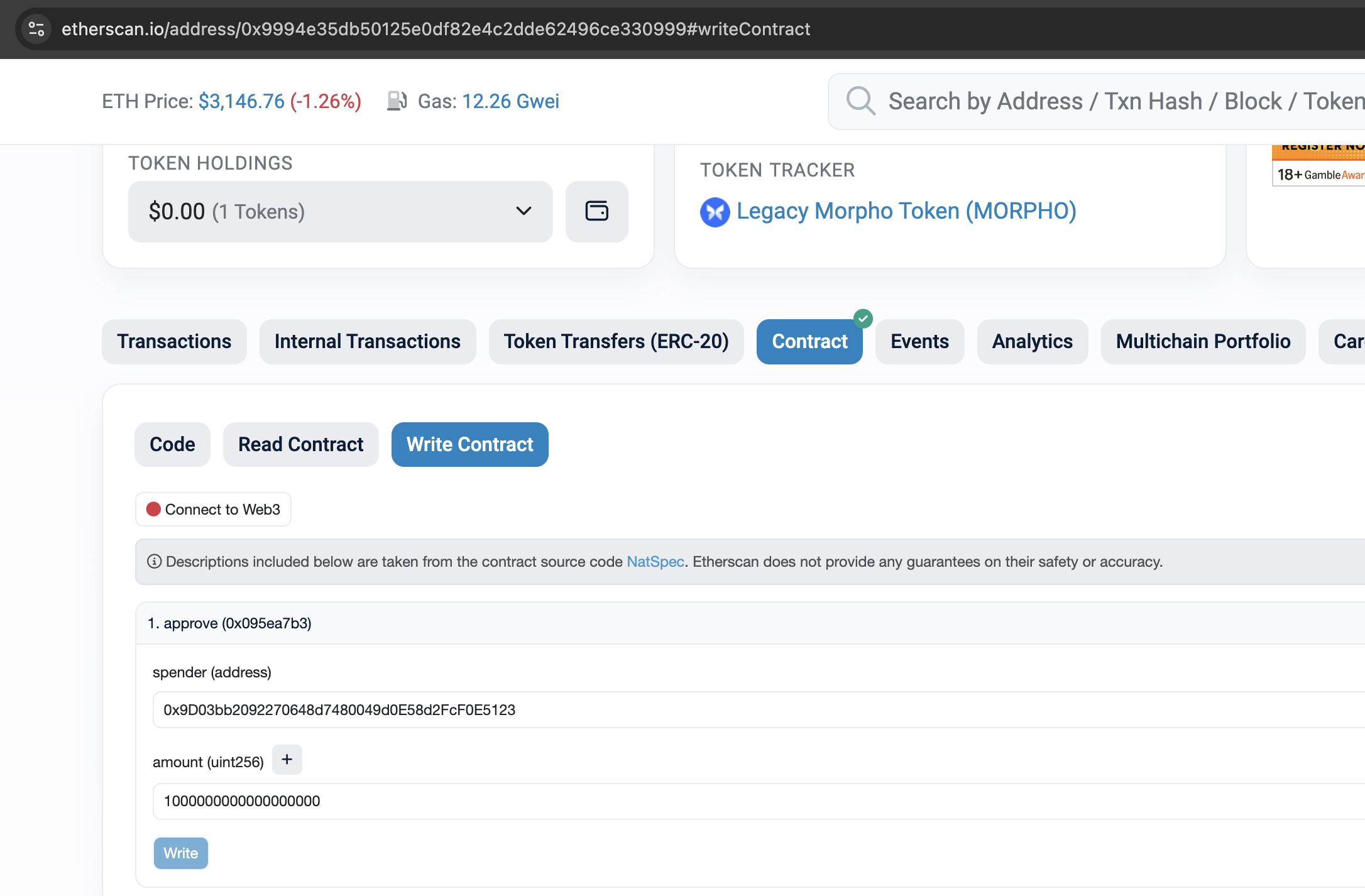

-

Connect your wallet to Etherscan.

-

Approve your Legacy MORPHO tokens to the wrapper. This can be done with the legacy token contract's

approvefunction, (the arguments should be the wrapper contract’s address and your amount of legacy tokens). E.g: - Wrapper address: 0x9D03bb2092270648d7480049d0E58d2FcF0E5123 - 1000000000000000000 for 1 Legacy MORPHO Token (18 decimals)

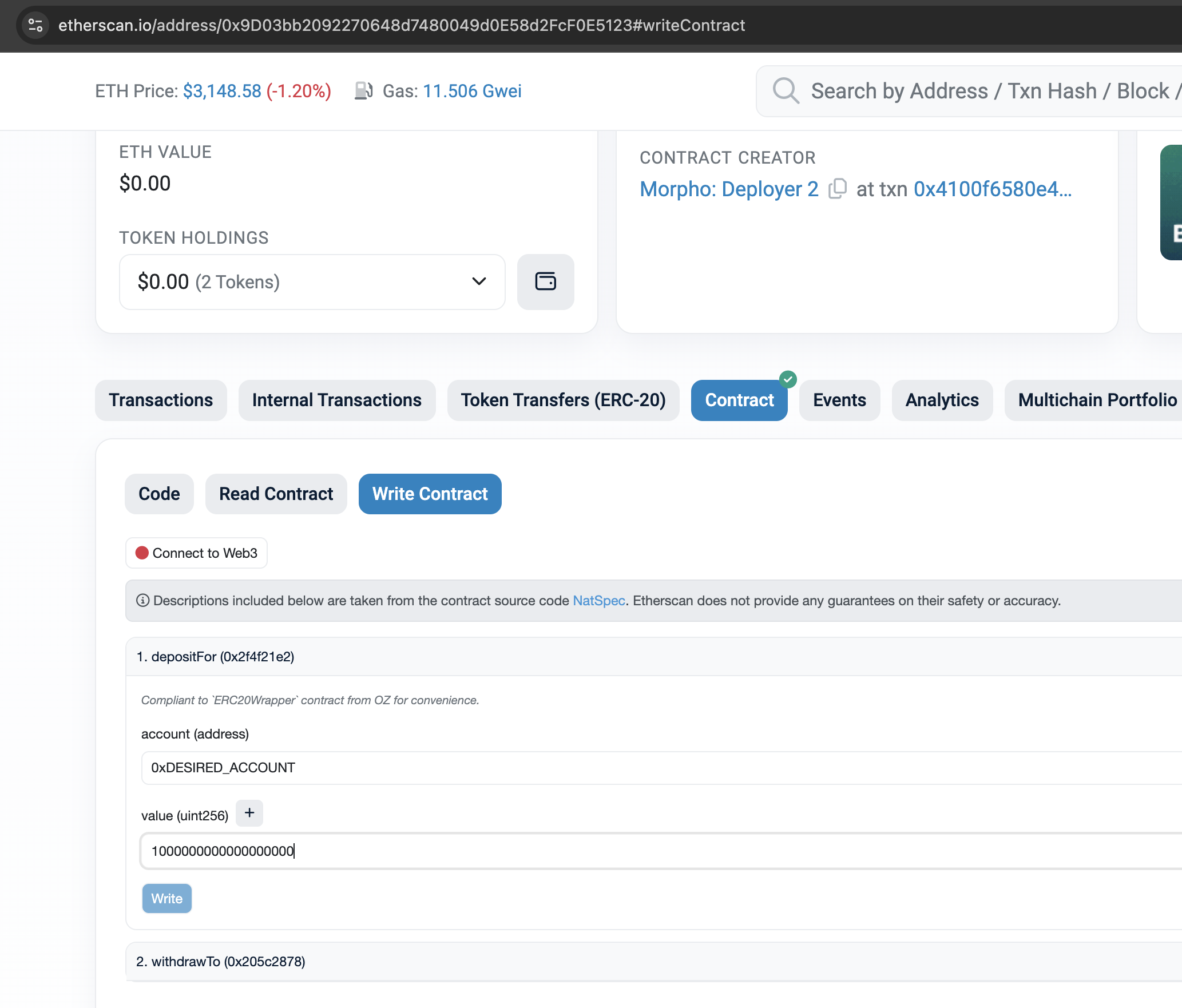

- Migrate your tokens on the wrapper by calling the wrapper contract’s

depositForfunction (the arguments should be your address, or another address if you want another recipient for the migrated tokens, and your amount of legacy tokens).

Feel free to get in touch via the chatbox on help.morpho.org.