Curator

A Curator in the Morpho ecosystem is an entity or individuals who aims to optimize the risk-adjusted returns for depositors based on a given strategy.

Curators are specifically responsible for the strategic curation of vaults, making key decisions about which markets to include, how capital is allocated, and how risk is curated within the vault structure. Their expertise directly impacts vault performance and security.

The Curator's Responsibilities

A Curator's duties revolve around high-level strategic decisions and risk curation. While the specifics of their toolkit have evolved from Vault V1 to V2, the core responsibilities remain consistent:

- Strategic Curation: Defining the vault's overall investment thesis. This includes selecting which protocols, markets, or asset types are permissible for allocation.

- Risk Parameterization: Setting and maintaining the risk boundaries for the vault. This involves defining exposure limits (caps) to various risk factors to protect depositor capital.

- Appointing Allocators: In Vault V2, the Curator is responsible for appointing the

Allocator(s)who will actively manage the portfolio within the established risk framework. - Setting Core Vault Mechanics: In Vault V2, the Curator also controls crucial mechanisms like fees and compliance gating.

Crucially, nearly all of a Curator's significant actions are subject to a timelock, providing transparency and giving depositors a window to exit if they disagree with a proposed change.

The Curator's Toolkit: V1 vs. V2

The tools available to a Curator have significantly expanded with Vaults V2, enabling far more sophisticated and granular risk curation.

| Feature / Tool | In Morpho Vault V1 | In Morpho Vault V2 |

|---|---|---|

| Protocol Selection | Limited to selecting individual Morpho Market V1 instances. | Can enable any protocol via Adapters, making the vault a universal gateway to yield (e.g., Morpho Market V1, Morpho Vault V1, more... ). |

| Risk Curation | Simple absolute supply caps per market. (e.g., "max 10M USDC in this specific market"). | Granular ID & Cap System. Can set both absolute and relative caps on abstract risk factors (e.g., "max 15M total exposure to stETH collateral across all markets" or "no more than 20% of the vault in protocols using Oracle X"). |

| Yield Curation | N/A. Interest was automatically accrued from the underlying markets. | Can set interest rate limits via maxRate to cap how quickly vault assets can grow, while adapters automatically report current asset values. |

| Fee Structure | N/A. Fees were managed by the Owner. | Sets the performance and management fees and their respective recipients. |

| Compliance | Not natively supported. | Can implement onchain compliance by setting Gate Contracts to control deposits, withdrawals, and share transfers. |

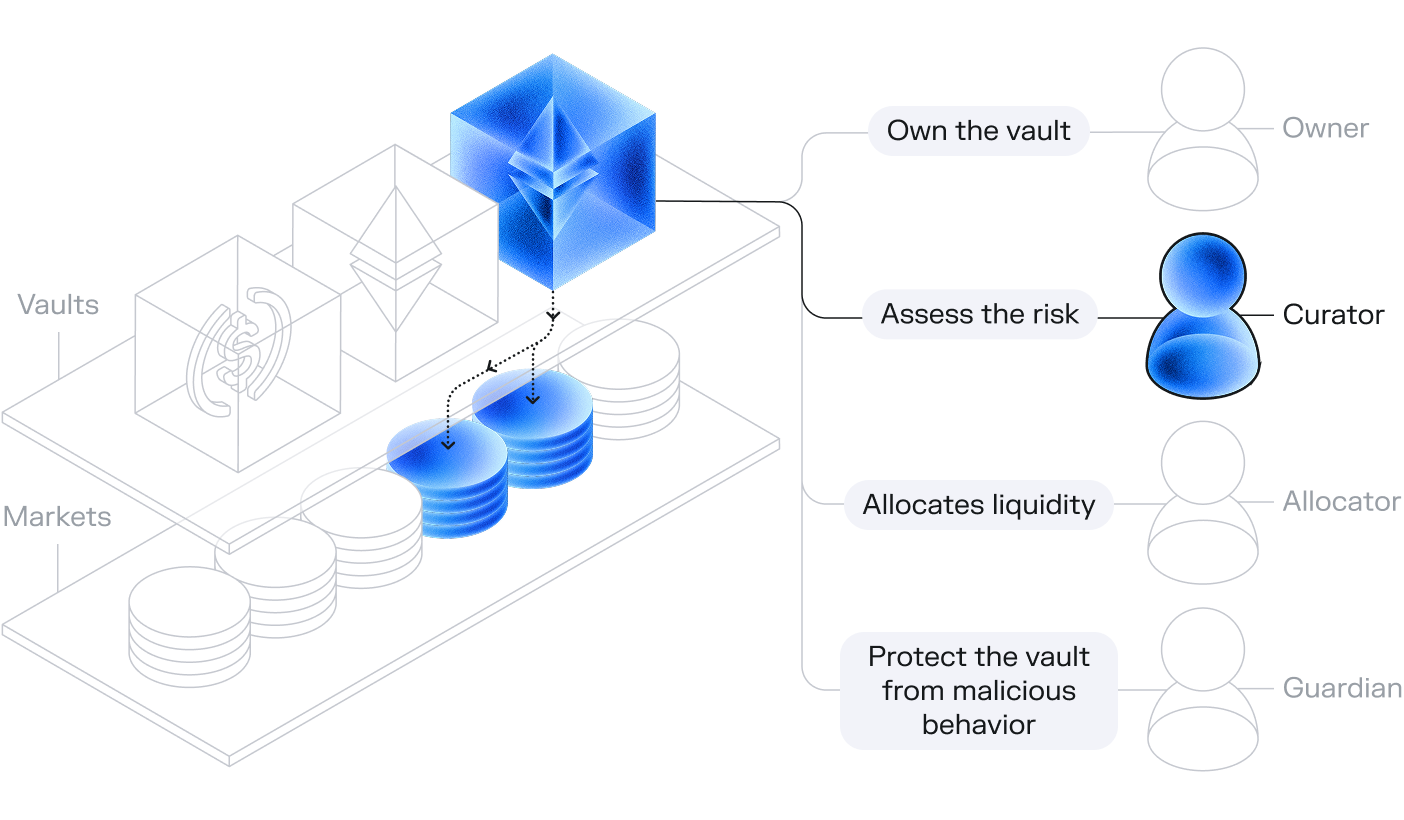

Curation within the Vault Role System

The Curator role is designed to be distinct from other vault management functions, creating a clear separation of duties.

- The Owner is the ultimate authority, with the power to appoint the

CuratorandSentinels. The Owner's role is primarily administrative. - The Curator defines the strategy and risk boundaries. They decide what is possible within the vault (which protocols, what max exposure).

- The Allocator is the tactical portfolio manager. Appointed by the Curator, they operate within the boundaries set by the Curator, deciding how to allocate capital among the permitted options to optimize yield.

- The Sentinel (the evolution of V1's

Guardian) is a safety mechanism. It can reactively reduce risk by decreasing caps or deallocating funds, and it can revoke pending timelocked actions from the Curator, acting as a crucial check on their power.

This structure ensures that strategic risk curation is separate from daily portfolio management (Allocation), leading to a more robust and secure system.