Public Allocator

What is the Public Allocator?

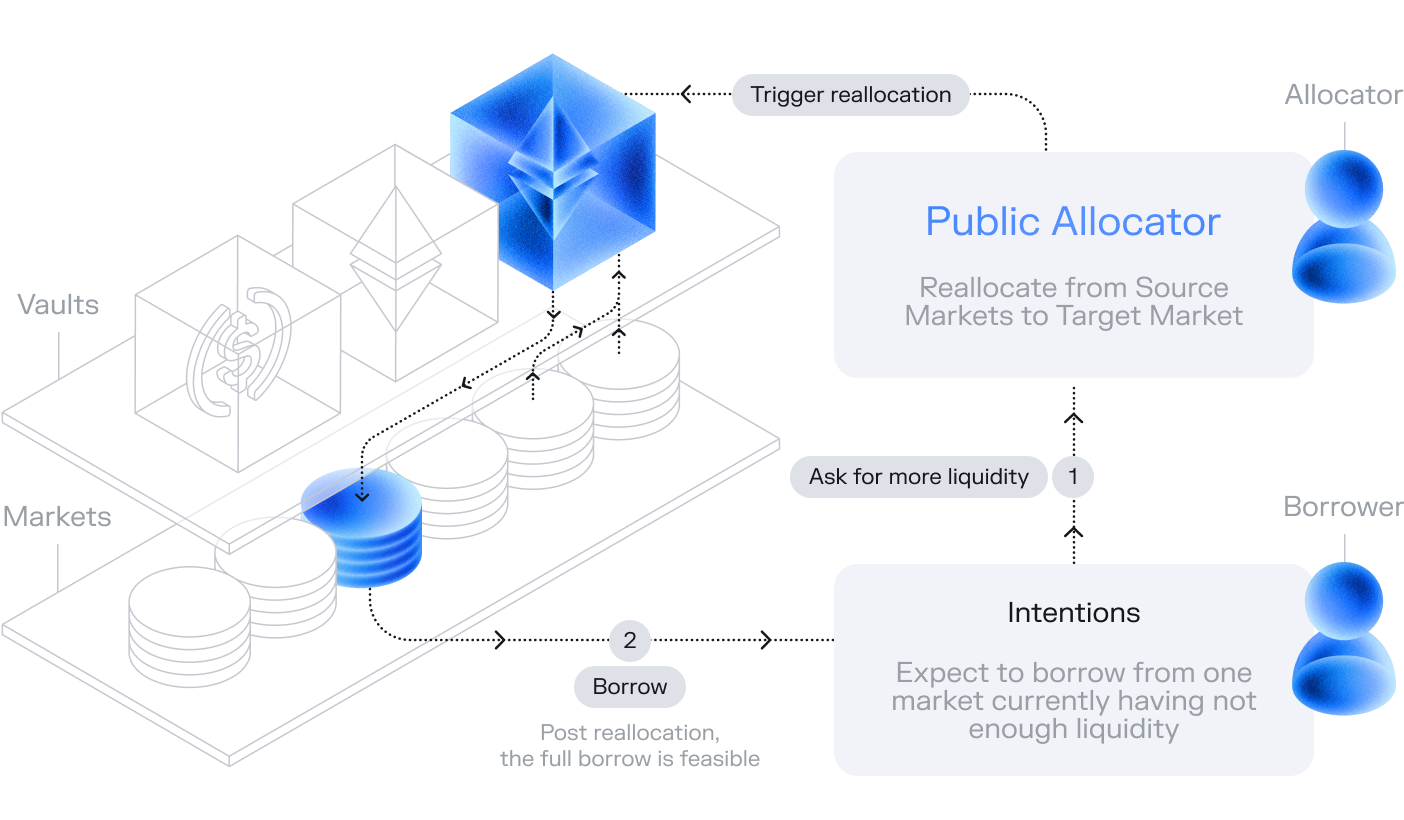

The Public Allocator is a smart contract that solves one of the biggest drawbacks of isolated markets: fragmented liquidity. It allows borrowers to access deep liquidity by automatically reallocating unused liquidity to the target market. Here is a video that explains how the Public Allocator works:

How It Works

When borrowing from a Morpho Market, users may find that the liquidity they need is distributed across multiple markets. Rather than requiring users to borrow from several different markets to reach their desired loan amount, the Public Allocator automatically handles this complexity. It seamlessly moves liquidity from other markets to the target market, making all funds available through a single borrowing transaction. This process happens behind the scenes and is completely transparent to the user.

Benefits

For Borrowers:- Access significantly more liquidity in one transaction

- Borrow larger amounts without hunting for fragmented liquidity

- Experience the simplicity of pool-based lending with the efficiency of Morpho

- Creates liquidity network effects across vaults

- Reduces the need for excessive capital concentration

- Maintains the security of isolated markets while offering pool-like convenience

Implementation

Vault curators control how the Public Allocator can move their funds by setting the Public Allocator contract with the Allocator role, and then sets:

- Flow Caps: Maximum amounts that can flow in or out of specific markets

- Market Preferences: Which markets can send or receive funds

- Fee Parameters: Optional fees that curators can set and collect for reallocations (these fees go to the curator, not to Morpho)

These controls ensure that while liquidity becomes more accessible, risk curation remains intact.

By bridging isolated markets with coordinated liquidity flows, the Public Allocator combines the best of both worlds: the risk curation of separate markets with the convenience of pooled lending.