Morpho Curation

Introduction to Curation

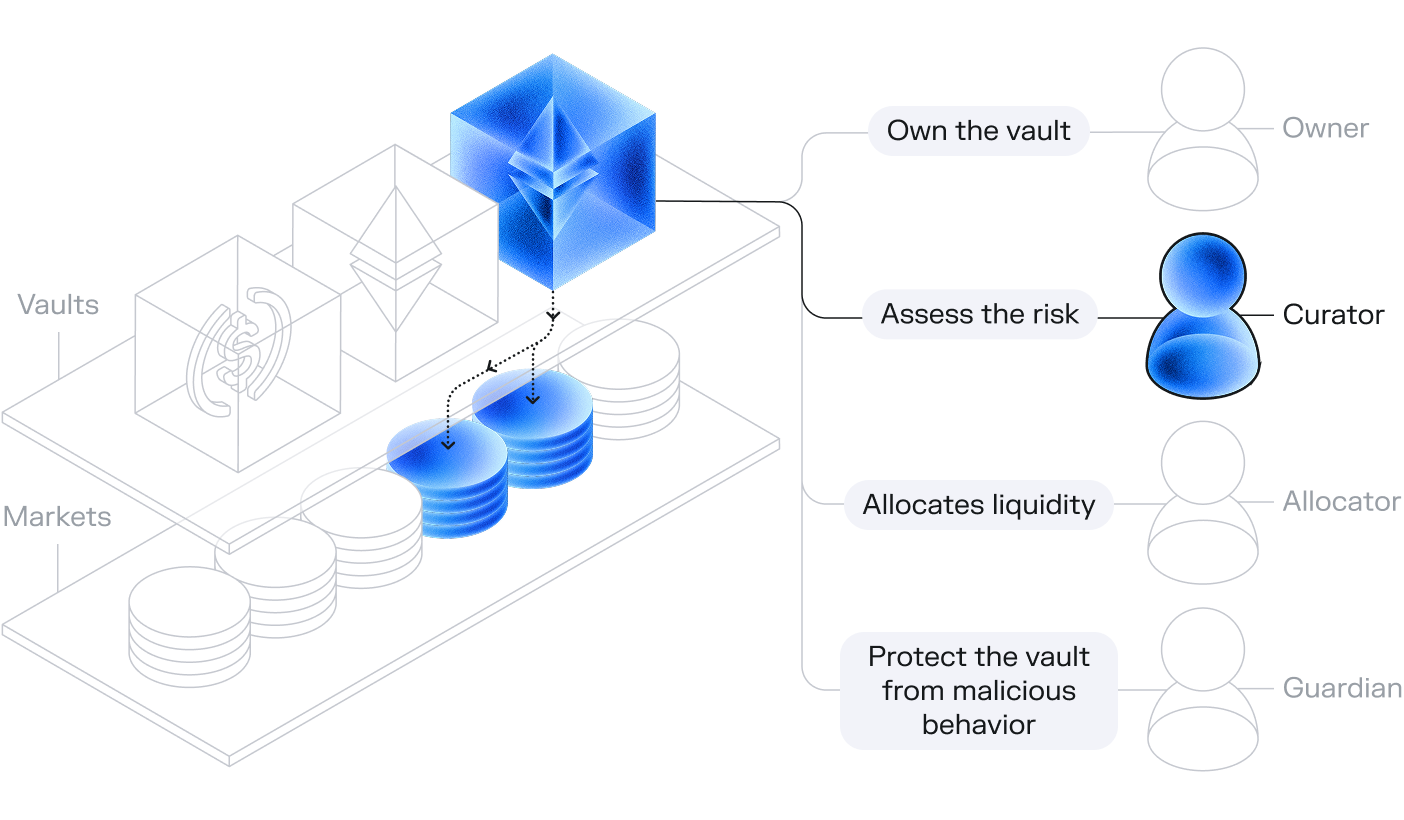

Curators are essential in balancing stakeholder needs and maintaining vault performance. This guide highlights the core aspects of effective vault curation.

Curator Responsibilities

Borrower Needs

- Competitive Rates: Access to markets offering attractive and competitive rates

- Liquidity Assurance: Reliable liquidity during market stress to prevent rate spikes

- Capital Allocation: Adequate capital support as positions grow

- Responsive Curation: Quick adaptations to changing market conditions

Depositor Needs

- Risk Mitigation: Zero tolerance for bad debt events

- Competitive Yields: APYs that align with risk profiles

- Security & Monitoring: Robust security measures and continuous collateral liquidity oversight

- Transparency: Clear and ongoing risk assessments

Operational Requirements

Admin Tasks

- Role & Security Configuration: Establish and maintain secure role assignments

- Market Listings: Create and manage market listings effectively

- Fee & Cap Adjustments: Update vault fee parameters and adjust allocation caps

- Public Settings: Configure public allocation parameters

Market Curation

- Liquidity Reallocation: Automate transfers between markets to optimize capital efficiency

- Performance Monitoring: Track vault APYs against benchmarks

- Risk Assessment: Evaluate liquidity risks, oracle reliability, collateral fundamentals, chain-specific factors, and multisig security

- Health Tracking: Continuously monitor borrower conditions and optionaly execute liquidation processes for at-risk positions

Reward Mechanisms

- MORPHO Rewards: Distributed to whitelisted markets and, in part, passed directly to vault depositors

- Oracle Integration: Utilizes onchain price feeds from providers such as Chainlink, Api3, Redstone, Pendle, Hashnote, Chronicle, and Pyth

- Blockchain-Specific Deployment: Rewards distribution varies by blockchain, with official deployments receiving priority

- Additional Configurations: Extra market-level or vault-level rewards can be set up following the reward programs guide

Public Allocator Integration

The Public Allocator (PA) significantly enhances vault performance:

- Enable the PA on all vaults to maximize capital efficiency while maintaining risk parameters

- Set flow configurations strategically:

- Open flows between markets sharing identical risk profiles

- Configure idle market flows to manipulate rates while preserving borrower access

- Set idle market

flow into zero unless bot reallocation is desired

- Leverage third-party integrations like Contango and DefiSaver to drive additional volume

Key Advantages for Curators

- Optimized Capital Efficiency: Benefit from advanced market-matching algorithms

- Granular Risk Control: Configure precise market exposure parameters

- Non-Custodial Security: Ensure transparent, immutable vault operations

- Dynamic Reallocation: Maintain competitive rates with automated reallocation tools

- Flexible Customization: Tailor vault parameters to meet diverse market needs

Get Started

New curators should begin with this overview to build a solid foundation, while experienced curators may reference specific sections for targeted guidance. This concise document is designed to enhance vault performance, manage risk effectively, and optimize returns for all vault users.

Refer to this section to dig into the specs of all smart contracts involved.