Interest Rate Model

Morpho is an Interest Rate Model (IRM) agnostic protocol, meaning it can support any interest rate model for its markets. In Morpho, the interest borrowers pay in a given market is defined by the IRM chosen at market creation among a governance-approved set.

The only IRM that has been governance-approved is the AdaptiveCurveIRM, which is described in more detail later in this page.

Understanding Borrow and Supply APY

The Annualized Percentage Yield (APY) is a critical metric that standardizes interest rates over a one-year period by accounting for compounding. In the context of lending protocols, two key APYs are:

-

Borrow APY: This reflects the effective annual interest cost that borrowers incur. It is derived from the instantaneous interest rate provided by the chosen Interest Rate Model (IRM). Essentially, the Borrow APY tells borrowers how much they will pay on an annual basis for borrowing funds.

-

Supply APY: This indicates the effective annual yield that lenders receive on their supplied assets. It is calculated by adjusting the Borrow APY based on the market's utilization rate and any applicable fees. The Supply APY, therefore, not only factors in the raw interest rate but also considers the portion of the rate that is passed on to suppliers after accounting for the market's fee (currently no fees are activated thus the fee equals).

How Are These APYs Calculated?

Borrow APY Calculation

The Borrow APY is obtained by compounding the per-second borrow rate over the entire year. The formula is:

Here, borrowRate is the rate provided by the IRM and secondsPerYear equals 31,536,000.

Supply APY Calculation

The Supply APY is obtained by adjusting the Borrow APY like this:

Where:

- Utilization: Is the ratio of the total borrowed assets to the total supplied assets.

- Fee: The market's fee determined by governance - currently no fees are applied. (Scaled by WAD: 1e18)

Resources

For a deeper dive into the mechanics and the code behind these calculations, refer to the following resources:

- Interest Rate Model Repository: Explore the implementation and the smart contracts that power the IRM.

- IRM Interface Documentation: Review the interface definitions and understand how different IRMs integrate into the system.

- Introducing the AdaptiveCurveIRM article

This integrated approach ensures that both borrowers and suppliers have a clear understanding of the cost of borrowing and the returns on lending, all derived from a robust and governance-approved interest rate model.

Initially, this set is composed of one immutable IRM, the AdaptiveCurveIRM.

The AdaptiveCurveIRM

Overview

The AdaptiveCurveIRM is engineered to maintain the ratio of borrowed assets over supplied assets, commonly called utilization, close to a target of 90%.

In Morpho, the collateral supplied is not rehypothecated. Removing this systemic risk removes the liquidity constraints imposed by liquidation needs. It enables more efficient markets with higher target utilization of capital and lower penalties for illiquidity, resulting in better rates for both lenders and borrowers.

As with every parameter of a Morpho Market, the IRM address is immutable. This means that neither governance nor market creators can change it at any given time. As such, the AdaptiveCurveIRM is designed to adapt autonomously to market conditions, including changes in interest rates on other platforms and, more broadly, any shifts in supply and demand dynamics.

Its adaptability enables it to perform effectively across any asset, market, and condition, making it highly suitable for Morpho's permissionless market creation.

How It Works

The model can be broken down into two complementary mechanisms:

-

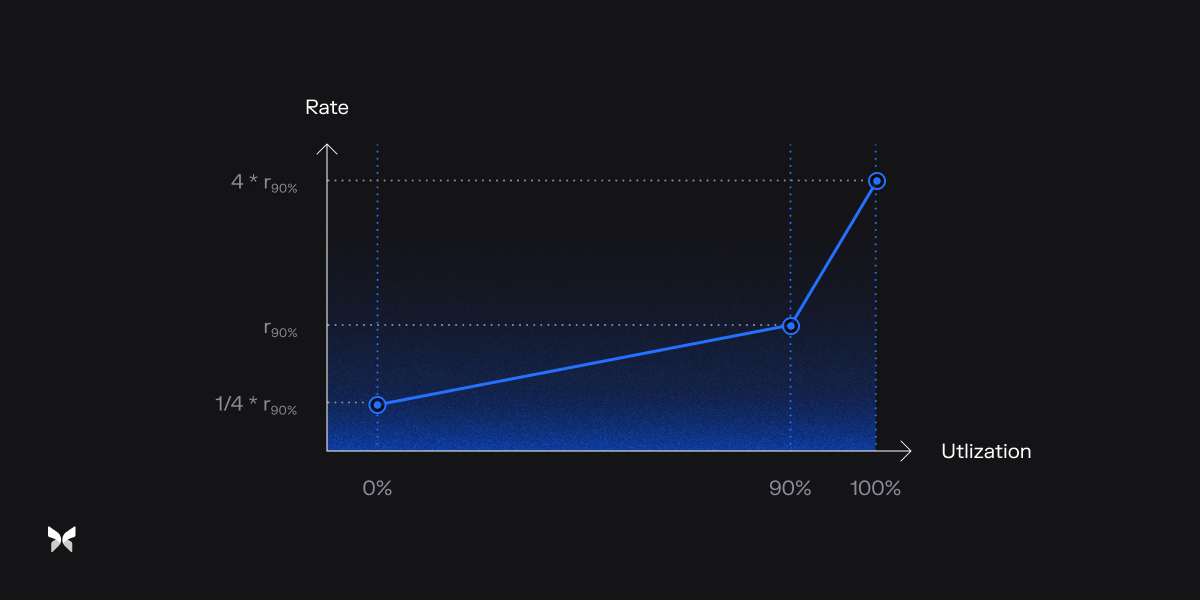

The Curve Mechanism This mechanism is akin to the interest rate curve in traditional lending pools. It manages short-term utilization effectively, maintaining capital efficiency while avoiding excessively high utilization zones that could lead to liquidity issues.

is the target rate at utilization target

-

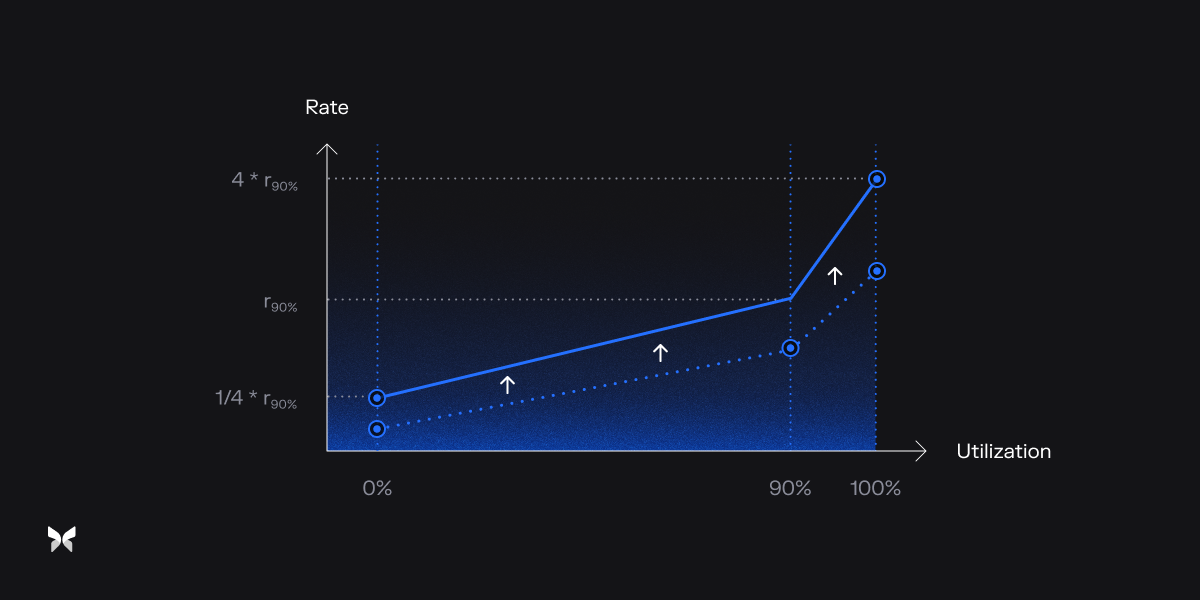

The Adaptive Mechanism This mechanism fine-tunes the curve over time to keep the range of rates in sync with market dynamics. It achieves this by adjusting the value of the target rate, which in turn shifts the entire curve:

- When utilization exceeds the target, the curve continuously shifts upward. This incentivizes loan repayment and thus decreases utilization.

- When utilization falls below the target, the curve continuously shifts downward. This incentivizes borrowing and thus increases utilization.

The speed at which the curve adjusts is determined by the distance of current utilization to the target: the further it is, the faster the curve shifts. This incremental adjustment of the curve allows for rate exploration, ultimately stabilizing when the interest rate at the target utilization aligns with the market equilibrium.

Here's a video showing how the two mechanisms combine to adjust interest rates:

For more on the AdaptiveCurveIRM, explore the technical reference.