Liquidation on Morpho

Overview

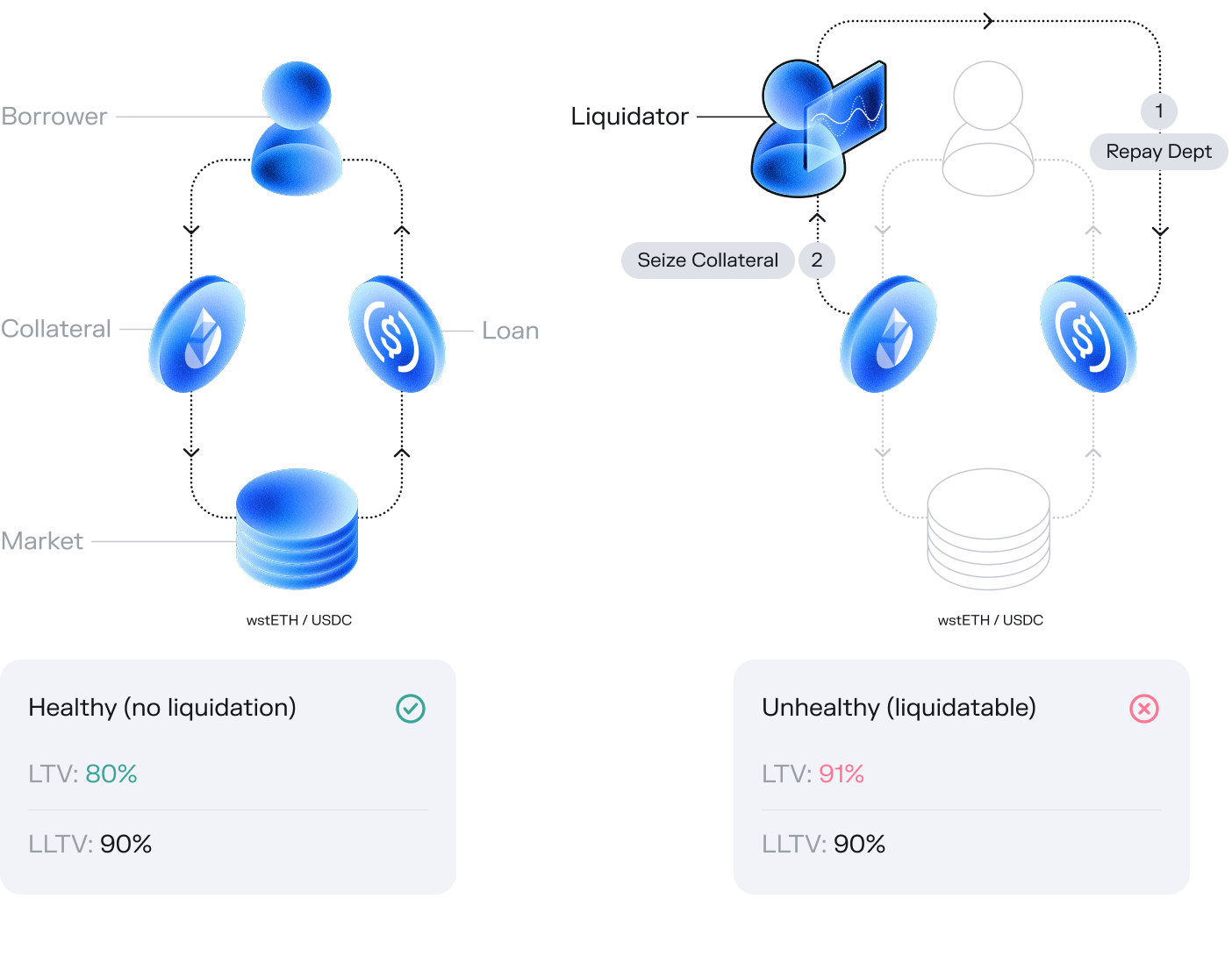

Liquidation is a critical mechanism in the Morpho protocol that protects lenders' capital by ensuring borrowers maintain healthy collateral positions. Morpho offers two liquidation approaches:

-

Standard Liquidation: A built-in mechanism at the protocol core that allows full or partial position liquidation when a borrower's Loan-To-Value (LTV) exceeds the Liquidation Loan-To-Value (LLTV) threshold.

-

Pre-Liquidation: An opt-in mechanism implemented in an external contract that enables smaller, incremental liquidations before reaching the standard liquidation threshold, creating a safety cushion for borrowers.

Understanding Loan-To-Value (LTV)

Before exploring the liquidation mechanisms, it's essential to understand how LTV is calculated and what it represents.

How to Calculate LTV

The Loan-To-Value (LTV) ratio is a key risk metric that measures the proportion of debt relative to collateral value. To calculate the LTV of a position on Morpho, use the following formula:

The collateral value in loan token units is calculated as:

Health Factor

The Health Factor is another crucial metric that indicates how close a position is to liquidation:

A position is healthy when the Health Factor is greater than 1.0. When it falls below 1.0, the position becomes eligible for liquidation.

Standard Liquidation

The standard liquidation mechanism is the primary defense against borrower defaults and is built directly into the Morpho core contracts.

When Is a Position Liquidatable?

A position becomes liquidatable when its LTV exceeds the market's Liquidation Loan-To-Value (LLTV) which can happen due to:

- Collateral value decreasing

- Debt increasing due to accrued interest

- A combination of both factors

How Standard Liquidation Works

When a position becomes liquidatable, any external party (a liquidator) can repay part or all of the borrower's debt in exchange for an equivalent amount of collateral plus a liquidation bonus.

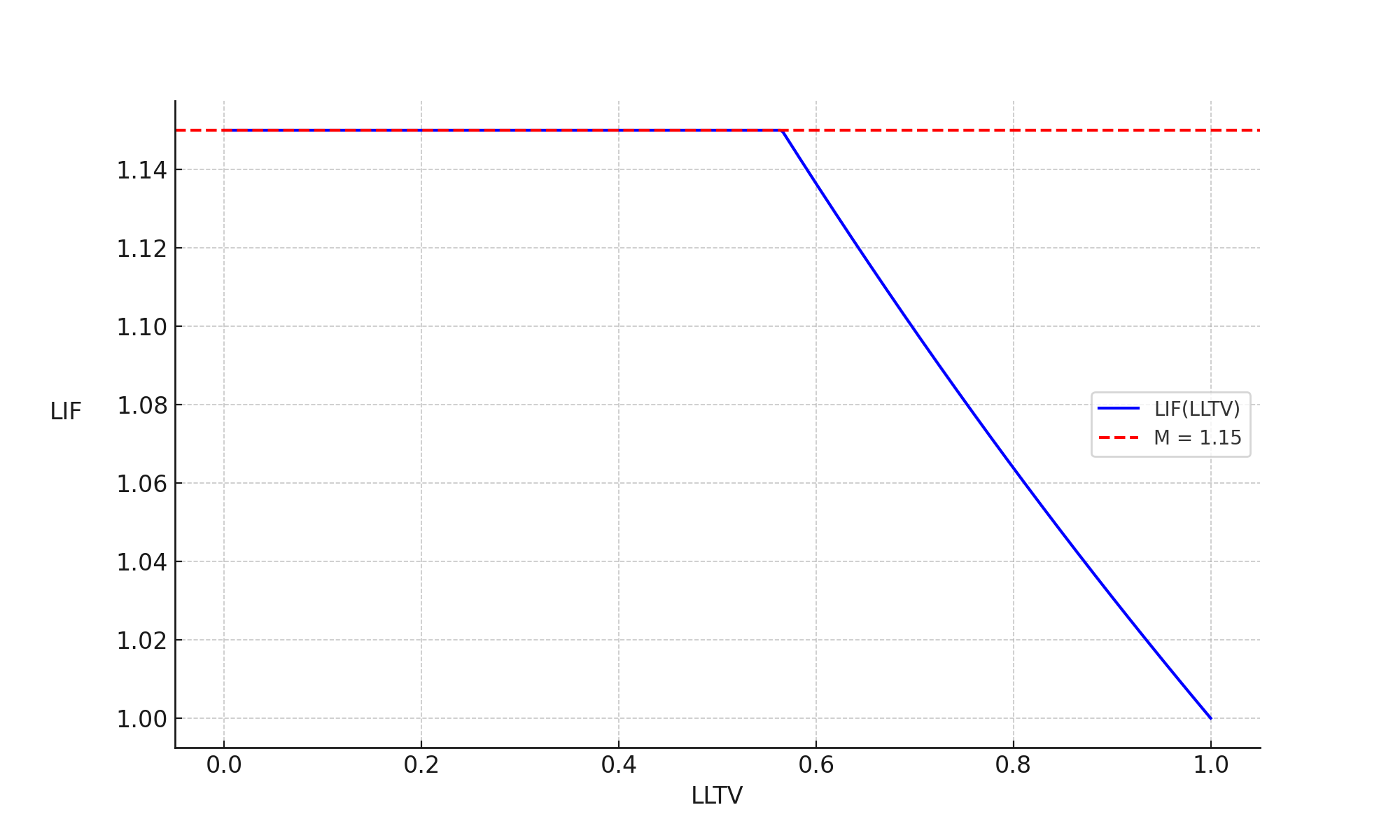

Liquidation Incentive Factor (LIF)

The liquidation bonus is determined by the Liquidation Incentive Factor (LIF), which depends on the market's LLTV:

Liquidation Incentive Factor in relation to the Liquidation Loan-To-Value

Standard Liquidation Step-by-Step

Initial Position

A borrower deposits $100k of collateral in a market with LLTV = 86% and borrows $70k. Due to accrued interest (an example could be provided with only collateral price depreciation), the loan value increases to $86.01k.

- Position status: LTV = 86.01% > LLTV (86%) → Liquidatable

Liquidation Process

- Liquidator identifies the unhealthy position

- Liquidator repays the $86.01k debt

- LIF calculation: 1.05 (for 86% LLTV market)

- Seized collateral: $86.01k × 1.05 = $90.31k

After Liquidation

- Borrower: Debt cleared, retains $9.69k of collateral

- Liquidator: Spent $86.01k, received $90.31k in collateral

- Profit for liquidator: $4.3k minus gas fees and any swap costs

Practical Consideration

For this liquidation to be profitable, the liquidator must ensure: $4.3k > (Gas fees + potential swap fees + potential price slippage costs)

Key Features of Standard Liquidation

- Liquidation Amount: Liquidators can repay up to 100% of the borrower's debt in a single transaction

- Trigger: Only activates when LTV > LLTV

- Incentive: Fixed LIF based on the market's LLTV

- Borrower Impact: Potentially significant one-time liquidation

- Implementation: Built into the Morpho core contract

Pre-Liquidation

The pre-liquidation mechanism, also called Auto-Deleverage, is an optional, opt-in feature that provides a safety buffer between healthy positions and standard liquidation.

What Is Pre-Liquidation (also known as Auto-Deleverage)

Pre-liquidation allows partial position closure when a borrower's LTV exceeds a pre-defined threshold (preLLTV) but remains below the market's LLTV. This creates a cushion zone where borrowers face smaller, incremental liquidations rather than a single full liquidation.

How Pre-Liquidation Parameters Work

Pre-liquidation operates with 6 key parameters:

Pre-Liquidation Loan-To-Value (preLLTV)

The threshold at which pre-liquidation becomes possible

Pre-Liquidation Close Factors (preLCF₁ & preLCF₂)

The maximum percentage of debt that can be repaid in a single pre-liquidation. This scales linearly between preLCF₁ and preLCF₂ based on the position's LTV:

Pre-Liquidation Incentive Factors (preLIF₁ & preLIF₂)

The bonus received by pre-liquidators, which can scale linearly between preLIF₁ and preLIF₂ based on position health.

Pre-Liquidation Oracle (PRE_LIQUIDATION_ORACLE)

The oracle used to assess whether or not a position can be preliquidated. It could be the same oracle of the market, or another oracle.

Pre-Liquidation Step-by-Step

Let's walk through an example of how pre-liquidation works in practice:

Step-by-Step Process

Case 1: Pre-Liquidation

Initial Position Setup

Alice deposits 1 WBTC as collateral valued at 100k USDC and borrows 70k USDC.

Her initial LTV is calculated as:

Subscription to Pre-Liquidation

Alice opts into the pre-liquidation feature. Her position is set to be pre-liquidated when her LTV exceeds the preLLTV threshold of approximately 83%.

Market Price Movement to Pre-Liquidation Range

When the price of 1 WBTC falls to 84k USDC, the new collateral value becomes 84k USDC.

Her LTV then becomes:

At this stage, her position reaches the pre-liquidation trigger, yet the pre-liquidation close factor (preLCF) is very low – making liquidation at this point unprofitable.

Price Drops Further and Pre-Liquidation Becomes Profitable

The market continues to move and 1 WBTC reaches 83k USDC, so the collateral value now is 83k USDC.

Her updated LTV is:

Now the position is clearly in the pre-liquidation range. Under these conditions, the pre-liquidation close factor is recalculated using the formula:

Under some assumptions, this means that approximately 12% of the debt becomes eligible for liquidation.

Executing the Pre-Liquidation

A liquidator repays 12% of Alice’s outstanding debt:

With a pre-liquidation incentive factor (preLIF) of roughly 1.04, the seized collateral is calculated as:

After this pre-liquidation event, Alice’s remaining debt adjusts to about 61.6k USDC and her collateral rebalances to around 74.3k USDC, effectively returning her LTV to near the preLLTV of 83%.

Case 2: Standard Liquidation (No Pre-Liquidation Executed)

Initial Position Setup

Alice deposits 1 WBTC as collateral valued at 100k USDC and borrows 70k USDC, giving an initial LTV of 70%.

No Pre-Liquidation Trigger

If no liquidator acts during the pre-liquidation phase (for example, due to rapid market movement or other factors), Alice’s position remains unchanged while the market continues to decline.

Market Price Movement to Trigger Standard Liquidation

When the price falls further to 81k USDC per WBTC, the collateral value is now 81k USDC and her LTV becomes:

As her LTV now exceeds the Liquidation Loan-To-Value (LLTV) of 86%, her position becomes eligible for standard liquidation.

Executing Standard Liquidation

A liquidator repays the full 70k USDC of debt. With a standard Liquidation Incentive Factor (LIF) of approximately 1.05, the collateral seized is computed as:

Thus, the full liquidation of Alice's position is executed.

After Liquidation

- Alice: Her debt is cleared but she loses her collateral, with the net effect of incurring a higher loss.

- Liquidator: Gains the liquidation bonus (the difference between repaid debt and seized collateral), though fees and slippage costs apply.

In this case, the total loss for Alice is estimated to be around 3.5k USDC.

Key Features of Pre-Liquidation

- Trigger Zone: Activates when preLLTV ≤ LTV < LLTV

- Position Closure: Limited by preLCF (typically smaller than standard liquidation)

- Incentive: Can be dynamic (preLIF), typically lower than the standard LIF

- Borrower Impact: Smaller, incremental losses with position deleveraging

- Implementation: Opt-in via PreLiquidation contract

- Position After: Partially deleveraged, returns to potentially healthier LTV ratio (assuming parameters are wisely selected)

Comparing the Examples

| Aspect | Case 1: Pre-Liquidation Executed | Case 2: No Pre-Liquidation, Standard Liquidation |

|---|---|---|

| Trigger Point | LTV climbs to ≈84% (with preLLTV at 83%) | LTV reaches 86% (LLTV threshold) |

| Liquidated Debt Portion | Partial: 12% of the debt (8.4k USDC) | Full: 100% of the debt (70k USDC) |

| Liquidation Incentive | PreLIF ≈ 1.04 (4% bonus) | Standard LIF ≈ 1.05 (5% bonus) |

| Collateral Seized | ≈8.7k USDC worth for the liquidated portion | ≈73.5k USDC worth of collateral seized total |

| Post-Liquidation Position | Position remains open; new debt ~61.6k USDC with ~74.3k USDC collateral; LTV restored to ≈83% | Position is fully closed |

| Borrower’s Loss | Approximately $300 loss during partial liquidation | Higher loss; approximately $3.5k incurred at full liquidation |

| Potential Future Outcome | If price recovers, Alice’s position may improve | No recovery as the position is closed |

Comparing Liquidation Mechanisms

| Aspect | Pre-Liquidation | Standard Liquidation |

|---|---|---|

| Trigger Threshold | preLLTV ≤ LTV < LLTV | LTV ≥ LLTV |

| Position Closure | Limited by preLCF (typically less than 50% at preLLTV) | Up to 100% of debt |

| Incentive | Can be dynamic, typically lower than LIF | Fixed LIF |

| Borrower Impact | Smaller, incremental losses | Full one-time loss |

| Position After | Partially deleveraged, returns to healthier LTV | Usually fully closed |

| Implementation | Opt-in via PreLiquidation contract | Built into Morpho core |

| Oracle | Market oracle or specialized oracle | Market oracle |

| Opt-in Required | Yes (additional protection) | No (default protection) |

Bad Debt Consideration

Morpho has different mechanisms for accounting for bad debts depending on the vault version.

Morpho Vaults V2 - Loss Socialization

Morpho Vault V2 implements an automatic loss socialization mechanism where losses — including bad debt from underlying adapters — are detected and distributed proportionally across all shareholders through share price depreciation.

How It Works

-

Loss Detection: Each adapter reports the actual current value of its investments via a

realAssets()function. When bad debt occurs in an underlying adapter, this reported value automatically decreases. -

Loss Realization: During interest accrual, the vault compares the reported real asset value to its internally tracked total. If

realAssetshas dropped below the previously recordedtotalAssets, the vault updates its accounting downward to reflect the loss. -

Automatic Socialization: Share value is determined via

convertToAssets(), which computesshares × (totalAssets + 1) / (totalSupply + virtualShares). WhentotalAssetsdecreases, every share redeems for fewer assets. No shares are burned — all shareholders absorb the loss proportionally.

Important Considerations

- Management fee continue to accrue even during loss periods.

- Morpho Vault V1.1 caveat: Since Morpho Vaults V1.1 do not realize bad debt internally, a Morpho Vault V2 supplying to a Morpho Vault V1.1 via a

MorphoVaultV1Adapterwill not reflect the corresponding losses from that allocation. - Flash loan protection: The vault includes safeguards against share price manipulation around loss realization events, as losses are only accounted for once per transaction.

Morpho Vaults V1.0 - Bad Debt Realization

The Morpho Vaults created with the MetaMorpho FactoryV1.0 have a mechanism to account for and realize bad debt in the event it arises.

Typically, in other lending pool designs, accrued bad debt remains in the market forever until manual intervention to pay down the bad debt. If small enough, the markets can continue functioning. If it is significant, the market becomes unusable.

Morpho Vaults V1.0 treat bad debt differently. When a liquidation leaves an account with some remaining debt, and without collateral to cover it, the loss is realized and shared proportionally between all lenders.

As bad debt is realized at the time it occurs, a market can be used in perpetuity.

Morpho Vaults V1.1 - No Bad Debt Realization

The Morpho Vaults created with the MetaMorpho Factory V1.1 have a different mechanism as they do not realize bad debt and behave as other lending pools with accrued debt remaining in the market forever until manual intervention to pay down the bad debt.

Liquidation FAQ

At what price are liquidations done?

Liquidations occur at the current oracle price when a position's LTV exceeds the market's LLTV. The oracle price determines both when a position becomes liquidatable and the exchange rate during the liquidation process. The liquidator receives collateral valued at debt amount × LIF according to this oracle price, regardless of market conditions or price volatility elsewhere.

What happens if the collateral price continues to fall?

If the collateral price continues to fall after a position becomes liquidatable:

- The position becomes increasingly attractive for liquidators as they can seize a larger percentage of the collateral relative to its real market value

- Liquidators are incentivized to act quickly to capture this value

- The protocol's design encourages prompt liquidations to minimize systemic risk

- There is no price floor - the position remains liquidatable until someone repays the debt

What happens if the price recovers before liquidation happens?

If the collateral price recovers sufficiently before liquidation occurs:

- The position's LTV may drop below the LLTV threshold

- The position will no longer be liquidatable

- The borrower retains their full collateral and remains responsible for their debt

- This scenario highlights why borrowers should maintain a safety buffer below the LLTV

How do competing liquidators interact? Is it first-come-first-served?

Yes, liquidations operate on a first-come-first-served basis:

- The first transaction that successfully executes the liquidation claims the opportunity

- There is no auction or bidding mechanism

- In competitive environments, this can lead to MEV (Maximal Extractable Value) opportunities and potential gas price wars

- Advanced liquidators may use flashbots or other private transaction methods to secure their liquidation

Is there partial liquidation?

Yes. Liquidators can choose to liquidate any amount of the borrower's debt up to the full amount. This allows for optimizing gas costs against liquidation profits, especially for large positions where full liquidation might cause significant market impact.

How are liquidations guaranteed for assets like cbBTC/stETH?

Liquidations in Morpho are driven by economic incentives rather than absolute guarantees. The protocol doesn't perform liquidations itself; instead, when a position becomes unhealthy, it becomes eligible for liquidation by external actors. The system is designed with incentives (via the Liquidation Incentive Factor) to make liquidations profitable enough that third parties will consistently execute them.

For assets like cbBTC or stETH, the key factor is whether the market's specific LIF provides enough incentive to outweigh potential costs associated with liquidating that particular collateral type. The ability to perform partial liquidations also helps with larger positions, as they can be liquidated incrementally by multiple parties or in several steps.

Who are the liquidators and what tools do they use?

Liquidators are permissionless participants in the Morpho ecosystem. Anyone who identifies an eligible position and has the necessary funds can perform a liquidation. The ecosystem includes a diverse range of participants, from sophisticated teams running automated bots to individuals.

At a basic level, performing a liquidation only requires access to an RPC node and a wallet with sufficient funds. However, competitive liquidators typically utilize automated bots that continuously monitor onchain data (loan positions, oracle prices) to identify and execute liquidations efficiently.

Some liquidators implement swap systems allowing them to seize collateral and repay loans without needing to hold the loan asset beforehand, effectively acting as a liquidity venue. The Morpho ecosystem also includes open-source liquidation bots that community members can deploy.

Pre-Liquidation FAQ

Do I need to enable pre-liquidation manually?

Yes, pre-liquidation is an opt-in feature. Borrowers must explicitly authorize it and set their preferred parameters.

How much capital can pre-liquidation save?

The capital savings depend on several factors including market volatility and pre-liquidation parameters.

Can anyone perform pre-liquidations?

Yes, similar to standard liquidations, pre-liquidations are open to anyone who can identify eligible positions and execute the transaction. Some gated mechanisms can be implemented, but they are not pre-built at the pre-liquidation contract level.

How are pre-liquidation parameters determined?

Pre-liquidation parameters are fully customizable within their respective range. They should be determined using formulas that optimize for:

- Creating a sufficient cushion zone between preLLTV and LLTV

- Minimizing borrower losses while maintaining liquidator incentives

- Ensuring the position returns to a healthy state after pre-liquidation

What happens if no one pre-liquidates my position?

If no pre-liquidation occurs and your position's LTV reaches the LLTV, it becomes eligible for standard liquidation, which may result in higher losses.

Liquidation Tools

By understanding both standard liquidation and pre-liquidation mechanisms, users can better manage their risk on Morpho and protect their positions from adverse market movements.