Get Data

Before Starting

In this tutorial, you'll see three main ways to fetch data for Morpho Markets:

- API: Using the Morpho public API. This is the easiest and most direct way to get comprehensive, indexed data for most applications.

- Smart Contract: Fetching data directly onchain using read functions (or offchain via libraries like Viem). This is best for real-time, trustless data needed within other smart contracts or sensitive applications.

- SDK: Using the Morpho SDKs for pre-built abstractions that handle complex calculations (like interest accrual) and simplify development.

For each topic below, you'll find guides for each method where applicable. This structure helps you choose the best approach for your specific use case.

Discovery and Listing

Markets List

Quickly retrieve a list of all markets or filter for specific ones, like those whitelisted for incentives.

query {

markets {

items {

uniqueKey

lltv

oracleAddress

irmAddress

loanAsset {

address

symbol

decimals

}

collateralAsset {

address

symbol

decimals

}

state {

borrowAssets

supplyAssets

fee

utilization

}

}

}

}query {

markets(where: { whitelisted: true }) {

items {

uniqueKey

whitelisted

lltv

oracleAddress

irmAddress

loanAsset {

address

symbol

decimals

}

collateralAsset {

address

symbol

decimals

}

state {

borrowAssets

supplyAssets

fee

utilization

}

}

}

}Market Parameters

Fetch the core, immutable parameters for one or more markets.

query {

markets(

first: 100

orderBy: SupplyAssetsUsd

orderDirection: Desc

where: { chainId_in: [1, 8453] }

) {

items {

uniqueKey

loanAsset { address }

collateralAsset { address }

lltv

irmAddress

oracleAddress

}

}

}query {

marketByUniqueKey(

uniqueKey: "0x9103c3b4e834476c9a62ea009ba2c884ee42e94e6e314a26f04d312434191836"

chainId: 8453

) {

uniqueKey

loanAsset { address }

collateralAsset { address }

lltv

irmAddress

oracleAddress

}

}Market Metrics

Total Collateral, Borrow & Supply

Get the real-time state of liquidity and debt in a market.

query {

markets(

first: 100

orderBy: SupplyAssetsUsd

orderDirection: Desc

where: { chainId_in: [1, 8453] }

) {

items {

uniqueKey

state {

collateralAssets

collateralAssetsUsd

borrowAssets

borrowAssetsUsd

supplyAssets

supplyAssetsUsd

liquidityAssets

liquidityAssetsUsd

}

}

}

}query {

marketByUniqueKey(

uniqueKey: "0x9103c3b4e834476c9a62ea009ba2c884ee42e94e6e314a26f04d312434191836"

chainId: 8453

) {

state {

collateralAssets

borrowAssets

supplyAssets

liquidityAssets

}

}

}Market APY (Native & Rewards)

Get the real-time APY, interest rates, and accrual information for markets.

query {

markets(

first: 100

orderBy: SupplyAssetsUsd

orderDirection: Desc

where: { chainId_in: [1, 8453] }

) {

items {

uniqueKey

state {

borrowApy

avgBorrowApy

avgNetBorrowApy

supplyApy

avgSupplyApy

avgNetSupplyApy

rewards {

asset {

address

chain {

id

}

}

supplyApr

borrowApr

}

}

}

}

}query {

marketByUniqueKey(

uniqueKey: "0x9103c3b4e834476c9a62ea009ba2c884ee42e94e6e314a26f04d312434191836"

chainId: 8453

) {

state {

borrowApy

avgBorrowApy

avgNetBorrowApy

supplyApy

avgSupplyApy

avgNetSupplyApy

rewards {

supplyApr

borrowApr

}

}

}

}Interactive Interest Rate Visualization

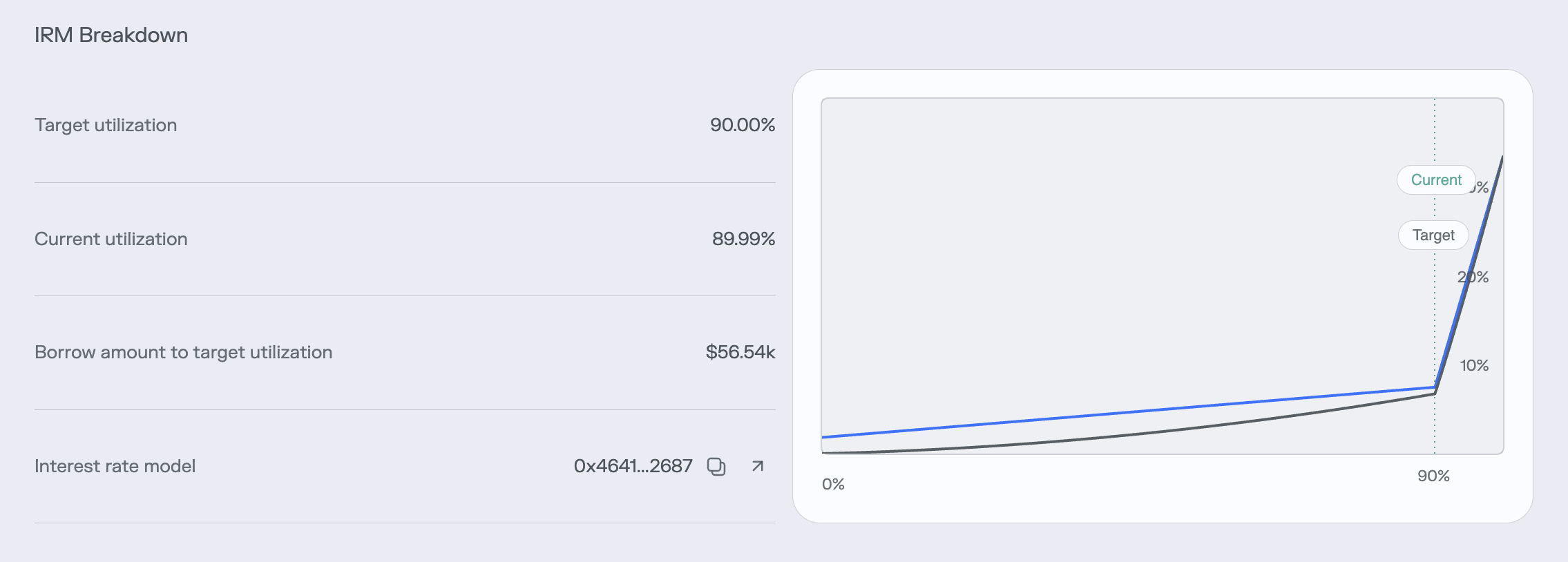

Understanding how the AdaptiveCurveIRM works in practice is crucial for developers integrating with Morpho Markets. This section provides a hands-on guide to implementing and visualizing the interest rate model calculations.

The Morpho protocol uses a kinked interest rate model (IRM) with a target utilization of 90%.

Below you'll find three approaches to working with this model: using the API, implementing it yourself, or understanding the mathematical foundation.

The easiest way to display the interest rate model is to use the Morpho API, which provides pre-calculated curve data with 101 data points (0% to 100% utilization).

Step 1: Query the GraphQL Endpoint

query GetMarketIrmCurve($uniqueKey: String!, $chainId: Int!) {

marketByUniqueKey(uniqueKey: $uniqueKey, chainId: $chainId) {

id

irmAddress

state {

id

utilization

}

currentIrmCurve {

utilization

supplyApy

borrowApy

}

}

}API Endpoint: api.morpho.org/graphql

This endpoint returns:

- Market identification data

- Current utilization state

- Pre-calculated interest rate curve with 101 data points

Step 2: Integrate with Frontend Component

const ChartInterestRateModelClient = ({ queryResult }) => {

const marketData = queryResult?.data?.marketByUniqueKey;

const shouldShowNoDataError = useMemo(

() =>

marketData?.currentIrmCurve?.length === 0 ||

marketData?.irmAddress === undefined,

[marketData?.currentIrmCurve?.length, marketData?.irmAddress]

);

return (

<Card padding="s" grow={1}>

<InterestRateModelChart

statuses={{

loading: false,

error: shouldShowNoDataError,

}}

height="288px"

data={marketData?.currentIrmCurve}

irmAddress={marketData?.irmAddress}

utilization={marketData?.state?.utilization ?? 0}

/>

</Card>

);

};- No need to implement rate calculations

- Pre-calculated data optimized for visualization

- Always up-to-date with latest protocol parameters

- Minimal code required for integration

Asset Information

Assets

Get metadata and pricing for specific tokens.

query GetAssetsWithPrice {

assets(where: { symbol_in: ["wstETH", "WETH"], chainId_in: [1] }) {

items {

symbol

address

priceUsd

chain {

id

network

}

}

}

}Position Tracking

User Position on Market

query {

marketPositions(

first: 10,

orderBy: BorrowShares,

orderDirection: Desc

where: {

marketUniqueKey_in: ["0x698fe98247a40c5771537b5786b2f3f9d78eb487b4ce4d75533cd0e94d88a115"]

}

) {

items {

user { address }

state {

collateral

borrowAssets

borrowAssetsUsd

}

}

}

}All Market Positions

query {

marketPositions(

first: 10

orderBy: SupplyShares

orderDirection: Desc

where: {

marketUniqueKey_in: [

"0x698fe98247a40c5771537b5786b2f3f9d78eb487b4ce4d75533cd0e94d88a115"

]

}

) {

items {

market {

uniqueKey

loanAsset {

address

symbol

}

collateralAsset {

address

symbol

}

}

user {

address

}

state {

supplyShares

supplyAssets

supplyAssetsUsd

borrowShares

borrowAssets

borrowAssetsUsd

collateral

collateralUsd

}

}

}

}Risk & Oracle Data

Oracle Data

query Markets($first: Int, $skip: Int, $orderBy: MarketOrderBy, $orderDirection: OrderDirection, $where: MarketFilters) {

markets(first: $first, skip: $skip, orderBy: $orderBy, orderDirection: $orderDirection, where: $where) {

items {

uniqueKey

oracle {

address

type

data {

... on MorphoChainlinkOracleData {

baseFeedOne {

address

}

baseFeedTwo {

address

}

baseOracleVault {

address

}

quoteFeedOne {

address

}

quoteFeedTwo {

address

}

scaleFactor

vaultConversionSample

}

... on MorphoChainlinkOracleV2Data {

baseFeedOne {

address

}

baseFeedTwo {

address

}

baseOracleVault {

address

}

baseVaultConversionSample

quoteFeedOne {

address

}

quoteFeedTwo {

address

}

quoteOracleVault {

address

}

quoteVaultConversionSample

scaleFactor

}

}

creationEvent {

txHash

timestamp

blockNumber

}

}

}

}

}query {

marketByUniqueKey(

uniqueKey: "0x9103c3b4e834476c9a62ea009ba2c884ee42e94e6e314a26f04d312434191836"

chainId: 8453

) {

uniqueKey

oracle {

address

type

creationEvent {

txHash

timestamp

blockNumber

}

data {

... on MorphoChainlinkOracleV2Data {

baseFeedOne {

address

}

baseFeedTwo {

address

}

baseOracleVault {

address

}

baseVaultConversionSample

quoteFeedOne {

address

}

quoteFeedTwo {

address

}

quoteOracleVault {

address

}

quoteVaultConversionSample

scaleFactor

}

... on MorphoChainlinkOracleData {

baseFeedOne {

address

}

baseFeedTwo {

address

}

baseOracleVault {

address

}

quoteFeedOne {

address

}

quoteFeedTwo {

address

}

scaleFactor

vaultConversionSample

}

}

}

}

}Liquidations

query {

transactions(

where: {

marketUniqueKey_in: [

"0x49bb2d114be9041a787432952927f6f144f05ad3e83196a7d062f374ee11d0ee"

"0x093d5b432aace8bf6c4d67494f4ac2542a499571ff7a1bcc9f8778f3200d457d"

]

type_in: [MarketLiquidation]

}

) {

items {

blockNumber

hash

type

user {

address

}

data {

... on MarketLiquidationTransactionData {

seizedAssets

repaidAssets

seizedAssetsUsd

repaidAssetsUsd

badDebtAssetsUsd

liquidator

market {

uniqueKey

}

}

}

}

}

}Market Warnings

Warning type can be:

unrecognized_collateral_asset: The collateral asset used in the market is not a part of the recognized token listunrecognized_oracle: The oracle used in the market is not recognizedunrecognized_loan_asset: The loan asset used in the market is not a part of our recognized token listbad_debt_unrealized& RED level: This market has significant unrealized bad debt (>25 BPS total supply)bad_debt_unrealized& YELLOW level: This market has some unrealized bad debt (>$10k)bad_debt_realized: This market has some realized bad debt (>10 BPS of total supply)

Warning level is either:

- YELLOW

- RED

query {

markets {

items {

uniqueKey

warnings {

type

level

}

}

}

}Integration

Vault Listing

The following query corresponds to which vault has this market in its supply queue

query {

marketByUniqueKey(

uniqueKey: "0x9103c3b4e834476c9a62ea009ba2c884ee42e94e6e314a26f04d312434191836"

chainId: 8453

) {

uniqueKey

supplyingVaults {

address

symbol

metadata {

description

}

}

}

}Historical Data

The historicalState allows to get historical data for certain queries. The queries need to be backfilled to return proper data (i.e. the historical data needs to be indexed and stored). Some queries are not backfilled and are flagged as deprecated in the Morpho API sandbox.

Available options when using an historicalState query:

startTimestamp: beginning of the historical data in UNIX timestamp format,endTimestamp: end of the historical data in UNIX timestamp format,interval: interval of the historical data points (YEAR,QUARTER,MONTH,WEEK,DAY,HOUR).

Inputting these options is not mandatory but it is advised to specify them to control the specific data returned.

If no options are specified, the default values will be:

startTimestamp: 0,endTimestamp: infinity,interval: will adjust according tostartTimestampandendTimestampto return around 50 data points.

Historical APYs

The example below mirrors the structure shown in the Morpho API sandbox, so you can copy/paste it directly when testing queries.

query MarketByUniqueKey($uniqueKey: String!, $chainId: Int, $options: TimeseriesOptions) {

marketByUniqueKey(uniqueKey: $uniqueKey, chainId: $chainId) {

historicalState {

borrowApy(options: $options) {

x

y

}

supplyApy(options: $options) {

x

y

}

}

}

}with the following variables

{

"uniqueKey": "0x608929d6de2a10bacf1046ff157ae38df5b9f466fb89413211efb8f63c63833a",

"options": {

"startTimestamp": 1707749700,

"endTimestamp": 1708354500,

"interval": "HOUR"

}

}Historical Market States

query MarketApys($options: TimeseriesOptions) {

marketByUniqueKey(

uniqueKey: "0x608929d6de2a10bacf1046ff157ae38df5b9f466fb89413211efb8f63c63833a"

) {

uniqueKey

historicalState {

supplyAssetsUsd(options: $options) {

x

y

}

borrowAssetsUsd(options: $options) {

x

y

}

}

}

}Historical Asset Price

query {

wstETHWeeklyPriceUsd: assetByAddress(

address: "0x7f39C581F595B53c5cb19bD0b3f8dA6c935E2Ca0"

chainId: 1

) {

historicalPriceUsd(

options: {

startTimestamp: 1707749700

endTimestamp: 1708354500

interval: HOUR

}

) {

x

y

}

}

}