Hedging its position using IPOR

Below is an illustrative example of how to create a simple fixed rate borrow using the Morpho and IPOR protocols

For this example we will use a borrow on Morpho, and a Pay Fixed swap on IPOR. The effective result will be a borrow rate which is fixed (or stable). In the case that the rate rises on Morpho, and therefore the cost, the derivative will be profitable and the winnings from the derivative would be able to pay the extra cost of credit. In the case the rate falls, the debt cost would be less but the derivative would be losing. In the end by using this strategy a user would be able to maintain an approximation of a fixed rate borrow with minimal basis risk.

In order to borrow stablecoins from Aave or Compound via Morpho and hedge the interest rate with IPOR effectively fixing the rate, you would need to:

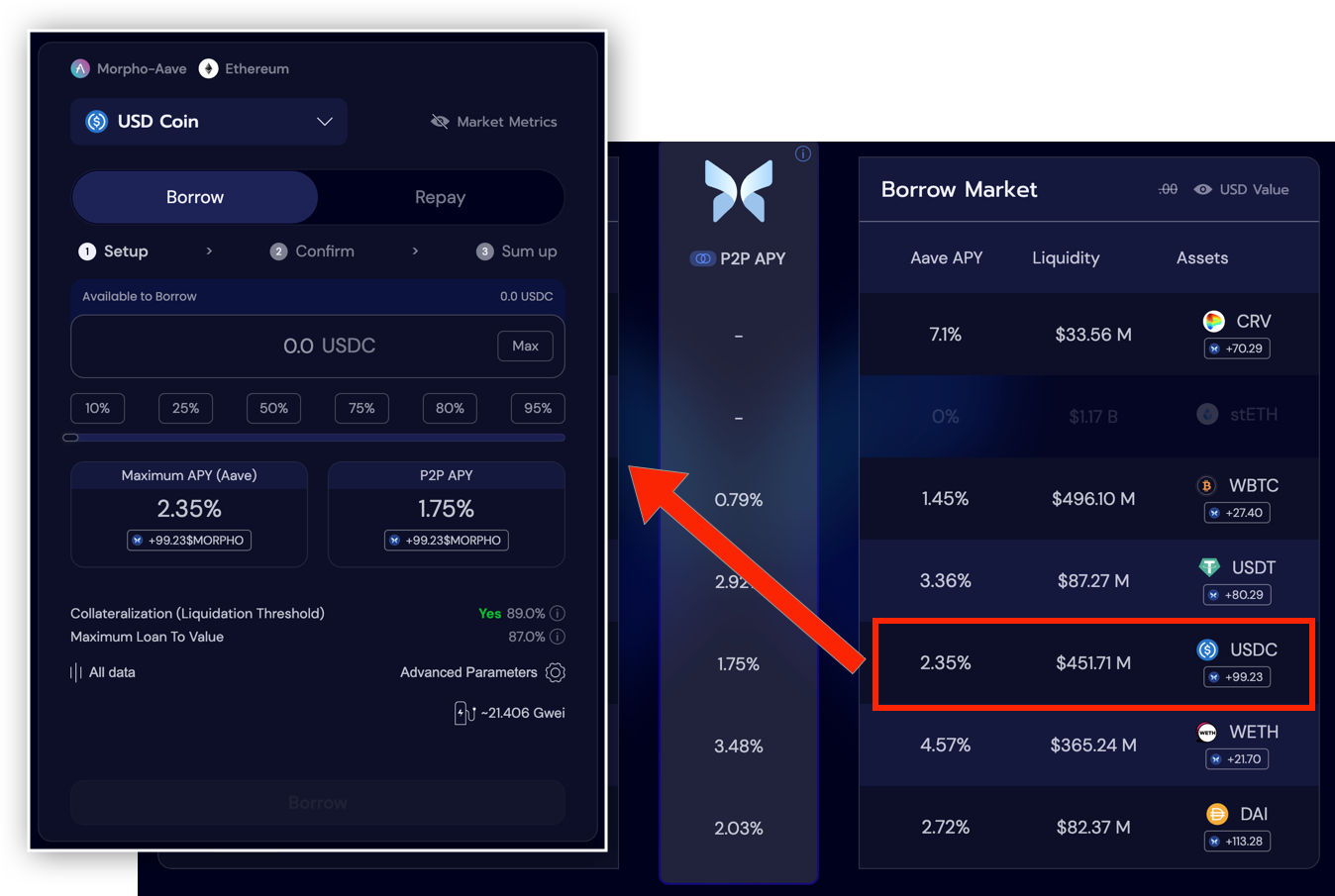

On Morpho

-

Go to Morpho's app and select the platform from which you want to borrow

-

Provide collateral (you will be able to borrow against it)

- select supported collateral

- make a transfer via Morpho

-

Head to "Borrow market" and borrow one of the supported IPOR stablecoins: USDT, USDC, or DAI. The amount you have borrowed should match "notional" amount on IPOR.

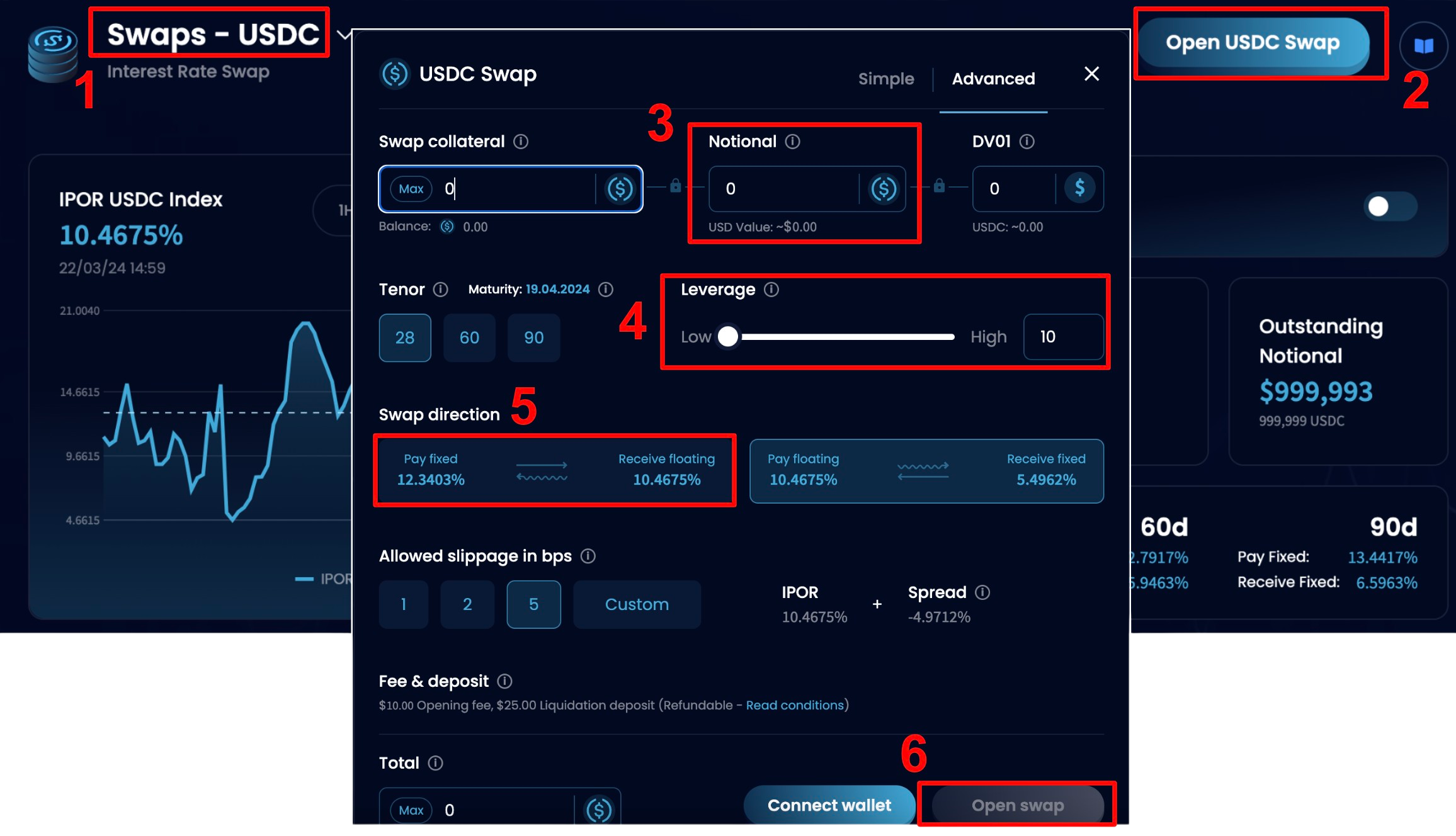

On IPOR

-

Head to IPOR swaps and select the same stable coin you have borrowed on Morpho

-

Click on "Open swap" for currency you have borrowed

-

Provide information:

- Set the Notional stands for the amount you borrowed.

- The Collateral is what one has to pay to use the IRS product, that will be potentially used after maturity (28 days).

- [Optional] Average Rate you expect is the rate that you think will be reached by the IPOR.

→ You will see the gain you will do by using the hedging strategies if you bet on an increase of the rate.

-

Set your preferred leverage

-

Choose Pay Fixed - Receive Floating (this type of swap is used to hedge borrow positions)

-

Open swap. Remember that the Maturity of a swap is 28 days. Your hedge is good for this long. If you close your borrow position before the 28 days maturity of your swap, you can also close the swap on the IPOR Protocol.