Morpho Vault V1

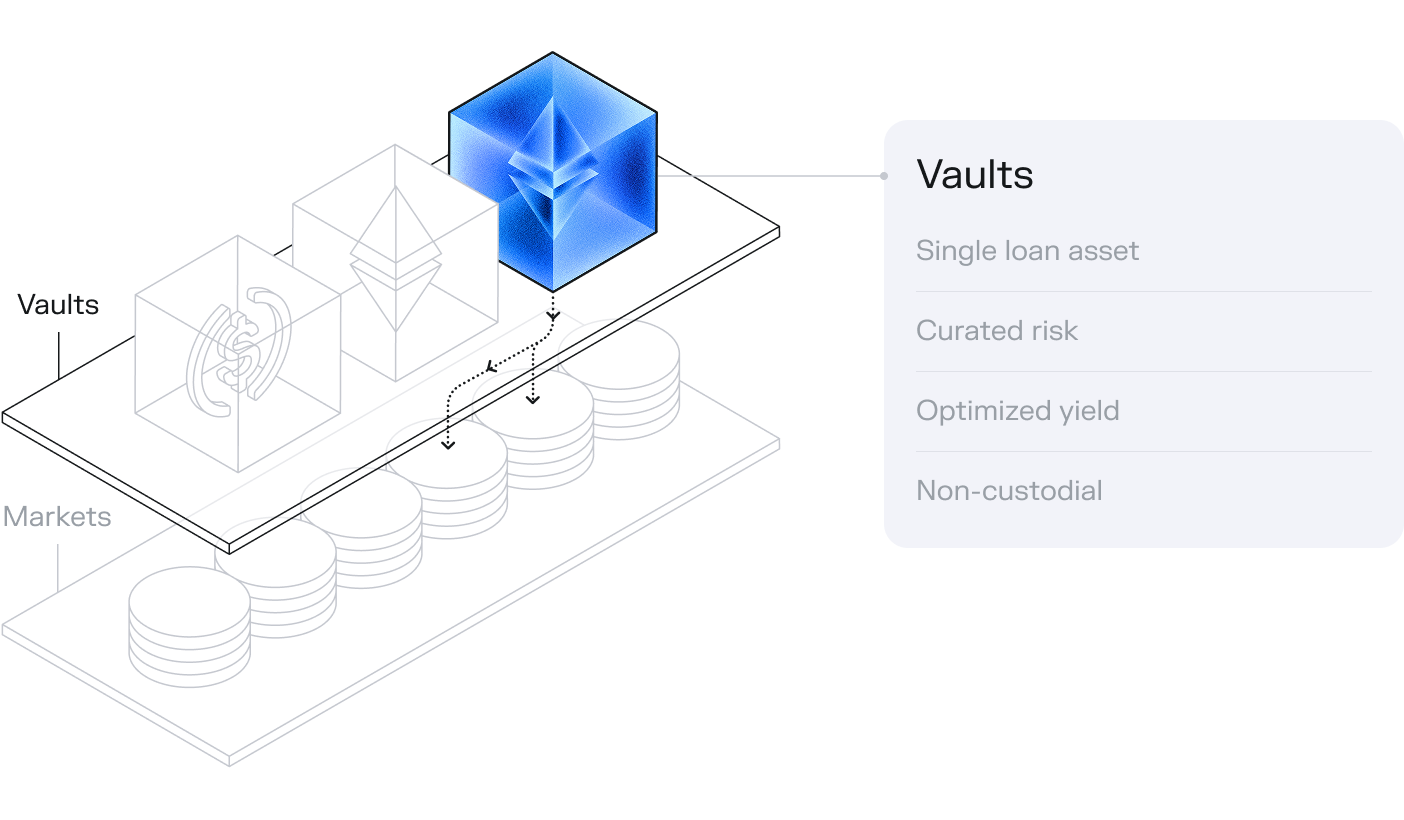

Morpho Vault V1 is a protocol for permissionless lending vaults built on top of the Morpho Markets V1.

What is a Morpho Vault V1?

A Morpho Vault V1 has one loan asset and can allocate deposits to multiple Morpho Markets V1. Users can deposit into a vault to start earning passive yield from interest paid by borrowers. Vaults feature automated risk curation, actively curating risk exposure for all deposited assets so users don't need to make these decisions themselves. Users maintain full control over their assets, can monitor the vault's state at any time, and withdraw their liquidity at their discretion.

Key Features

-

ERC-4626 Compatibility: Morpho Vaults implement the ERC-4626 "Tokenized Vault" standard, providing a consistent and interoperable way to interact with lending positions across the DeFi ecosystem.

-

Simplified Yield Generation: Vaults abstract away the complexity of managing positions across multiple lending markets, allowing users to deposit once and earn optimized yields.

-

Automated risk curation: Each vault is managed by specialized roles that handle market selection, risk assessment, and capital allocation to protect depositors.

-

Permissionless Liquidity: Users can deposit and withdraw at any time, with no lock-up periods, subject only to the available liquidity on the underlying markets.

-

Transparent Operations: All vault actions and allocations are visible onchain, with role-based management to ensure proper oversight and risk control.

Morpho Vaults serve as an accessible entry point for users who want to participate in DeFi lending markets without directly managing the complexities of individual positions, risk assessment, and market selection.

How It Works

- Curation and Market Selection: The

Curatorof the vault is responsible for risk curation. They select a set of Morpho V1 markets that are appropriate for the vault's strategy and set an absolute supply cap for each one. This cap limits the vault's maximum exposure to any single market. All risk-altering actions are subject to a timelock. - Capital Allocation: The

Allocatoris responsible for optimizing yield. They manage two queues:- Supply Queue: Defines the priority order for depositing new capital into the enabled markets.

- Withdraw Queue: Defines the priority order for withdrawing capital to meet user redemption requests.

The allocator can also

reallocatefunds between enabled markets to optimize utilization and yield.

- User Deposits and Withdrawals: When a user deposits, the vault routes the assets to markets in the

supplyQueueup to their respective caps. When a user withdraws, the vault pulls liquidity from markets in thewithdrawQueue.

Roles and Responsibilities

Morpho Vaults V1 use a system of distinct roles to separate powers and responsibilities:

- Owner: The highest level of control. The owner can appoint the Curator and Allocators and set vault-level parameters like fees.

- Curator: The primary risk curator. The Curator decides which Morpho Markets V1 the vault can supply to and sets the supply cap for each. These actions are timelocked for security.

- Allocator: The portfolio allocator. The Allocator actively manages the supply and withdraw queues and can reallocate capital between approved markets to optimize for yield and liquidity.

- Guardian: A safety role with the power to revoke pending timelocked actions proposed by the Owner or Curator, acting as a final check against malicious or erroneous changes.

A Note on V1.0 vs V1.1

The initial version of Morpho Vaults V1 was V1.0. An update, V1.1, was later released with a key change in how it handles bad debt from the underlying Morpho V1 markets.

- Morpho Vault V1.0: Realized bad debt from an underlying market atomically. This meant if a market suffered a loss, the vault's share price would immediately drop.

- Morpho Vault V1.1: Does not automatically realize bad debt. Instead, losses remain within the underlying Morpho V1 market, and the

lostAssetsvariable tracks them. This prevents flash loan-based share price manipulation attacks.