How can distributors generate revenue on Morpho?

Curators and distributor channels have different ways to charge fees.

A distributor channel is any platform, application, or service that integrates Morpho's functionality to offer it to their own users. This includes wallets, DeFi aggregators, portfolio management apps, or custom interfaces that embed Morpho vaults. These distributors make Morpho accessible to users who might not otherwise directly interact with the Morpho protocol, and they can earn fees by facilitating these interactions.

To generate revenue, a distributor has several possibilities developed below:

- Own its own revenue layer (a Fee Wrapper or a Vault V2 Wrapper)

- Have an agreement with a curator (onchain or offchain)

Fees

Morpho Vault V2 can charge 2 types of fees, while Morpho Vault V1 has only one:

| Fees | Vault V2 | Vault V1 |

|---|---|---|

| Performance fee (taken on the native yield) | ✅ 0% → 50% | ✅ 0% → 50% |

| Management fee (taken on the Assets Under Curation) | ✅ 0% → 5% | ❌ |

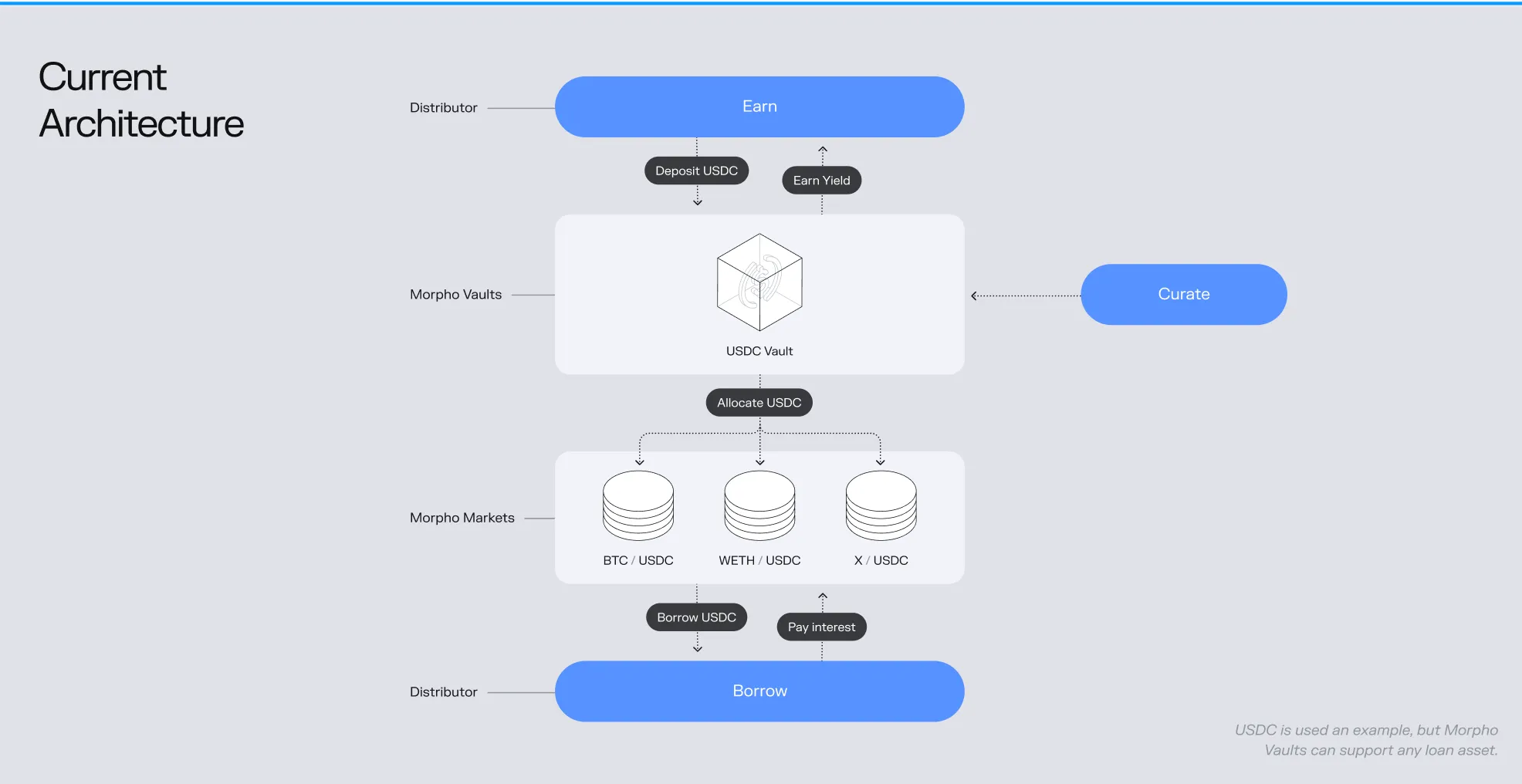

Architecture

Here is the setup of the current Earn architecture with USDC as an example

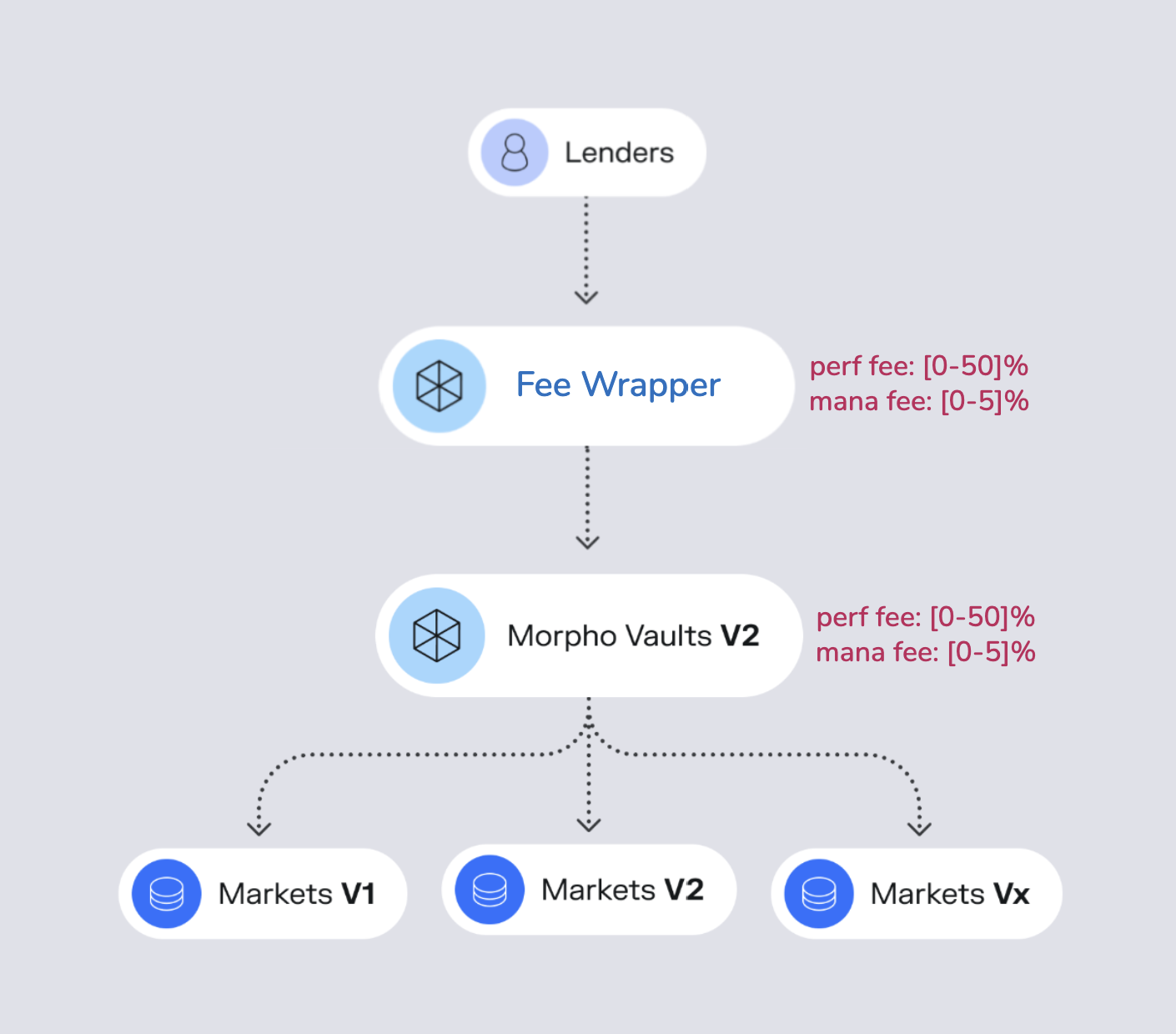

Here is the vault model illustrating asset flow in terms of allocation

Examples of possible configurations

| Model | Control | Trust Required | Complexity | Best For |

|---|---|---|---|---|

| Fee Wrapper | High | None | Low | B2B distribution, per-customer vaults |

| V2 Wrapper | High | None | Low | Independent distributors |

| Offchain Agreement | Shared | High | Medium | Strategic partnerships |

| Onchain Splitter | Shared | None | High | Formal trustless partnerships |

1. Fee Wrapper

A Fee Wrapper is a Vault V2 configured in a specific, constrained mode that enables distribution channels to add a fee layer on top of an existing Morpho Vault V2.

- Main Morpho Vault V2: Handles actual capital allocation to Morpho Markets (V1, V2, future versions). This is where yield is generated.

- Fee Wrapper: A lightweight Vault V2 that deposits into the main Morpho Vault V2, with the sole purpose of adding a fee layer per customer/distributor.

Key Properties

| Property | Description |

|---|---|

| ERC-4626 Compliant | All standard vault functions work as expected |

| Immutably Bound | Bound to a single Morpho Vault V2 at deployment. Can not be changed |

| Fee Flexibility | Owner can configure performance fees (up to 50%) and management fees (up to 5%) |

| Simplified Configuration | Risk management functions are abdicated, making operation simpler |

| Shared Liquidity | Users share the liquidity of the underlying Morpho Vault V2 |

Use Cases

- B2B Distribution: Distributors can deploy one Fee Wrapper per customer, each with custom fee configurations

- Revenue Sharing: Split native yield between the distribution channel and end users (e.g., 50/50 split via fee configuration)

- White-Label Products: Distributor can offer Morpho yield under their own brand with their own fee structure

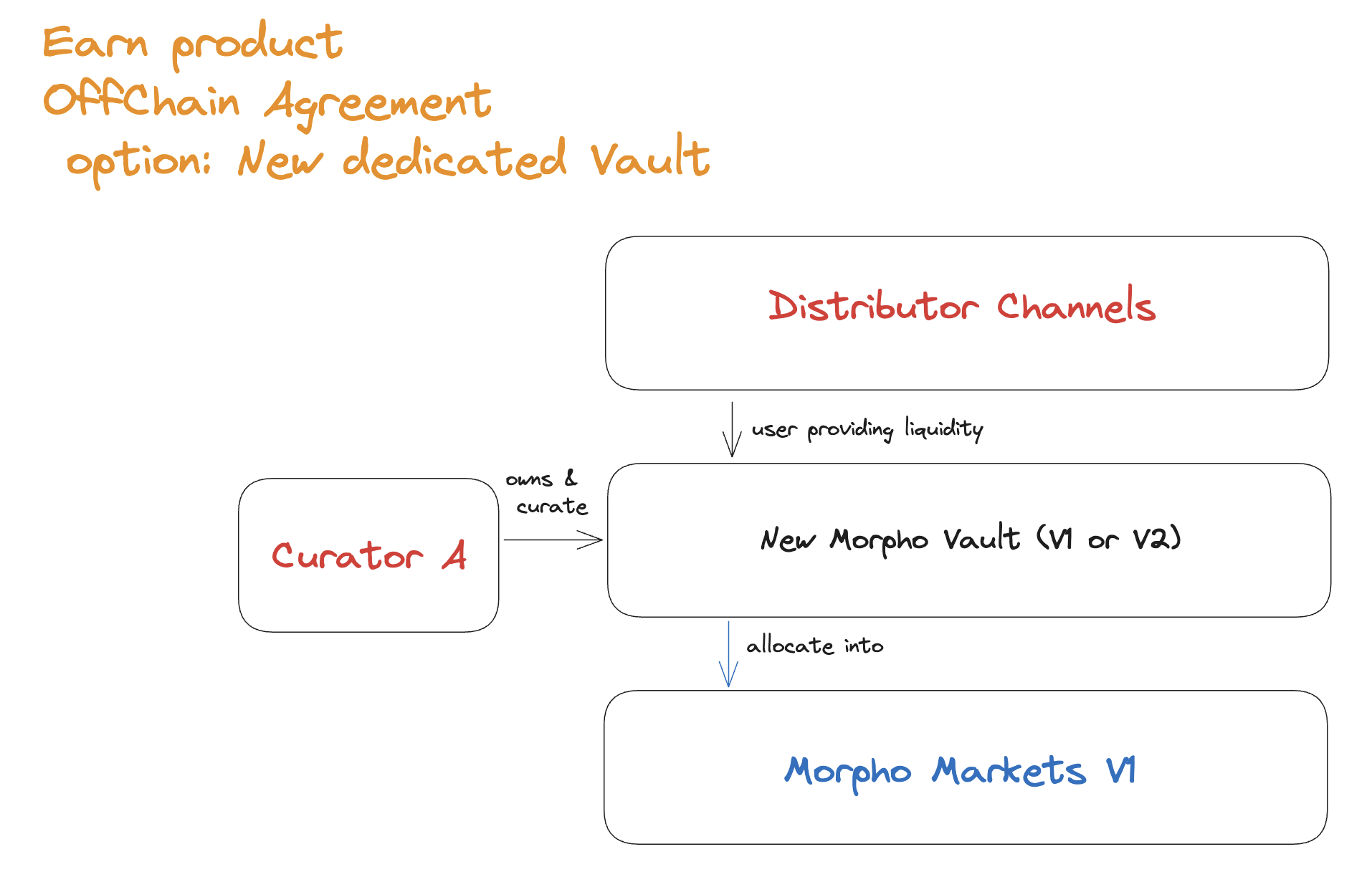

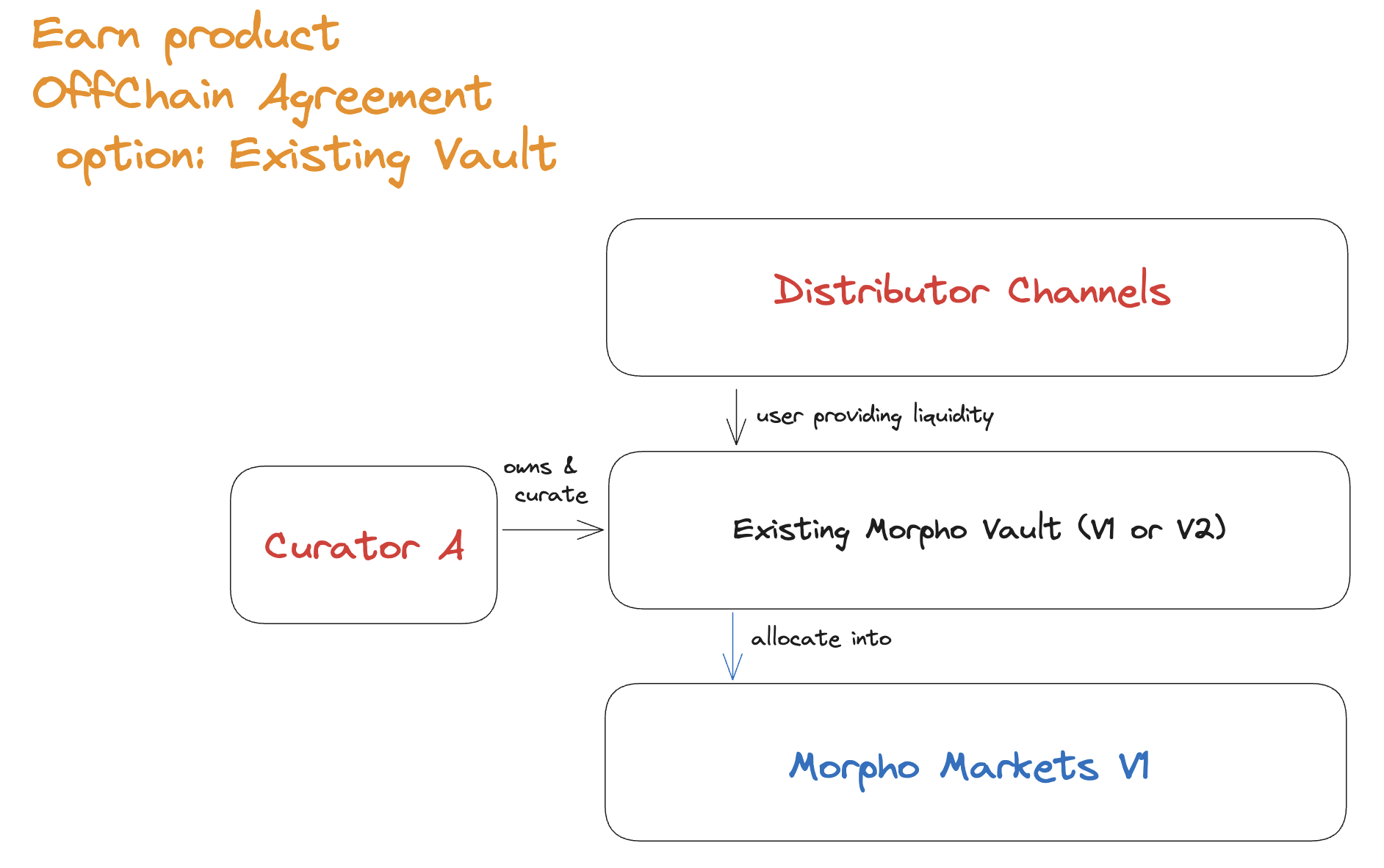

2. Offchain Agreement Model

Setup: Distributor and curator establish a legal revenue-sharing agreement for liquidity provided.

Two Options: Option A - New Dedicated Vault:

- Curator launches new vault (V1 or V2) exclusively for distributor's users

- Fee split negotiated up-front (e.g., 50/50 on performance fees)

- Clean attribution of liquidity and fees

Option B - Existing Vault:

- Distributor directs users to existing vault

- Revenue share calculated based on tracked liquidity contribution

- Requires tracking mechanism (transaction mapping, user addresses, time-weighted deposits)

- Legal contract enforces agreement

- Option B requires reliable attribution system

- Settlement handled offchain (periodic payouts)

Use Case: Best for strategic partnerships where trust exists or when onchain complexity isn't warranted.

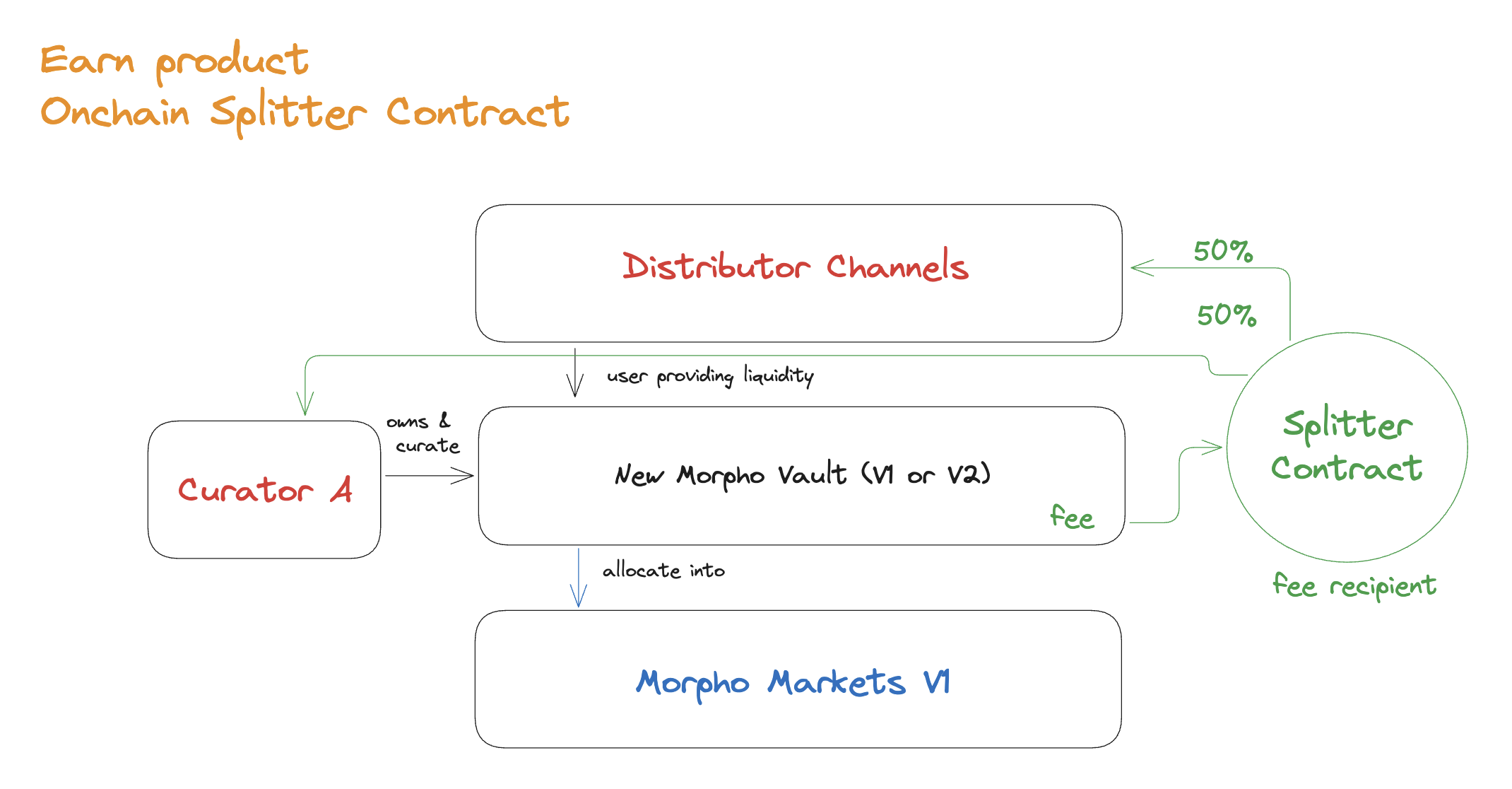

3. Onchain Splitter Contract Model

Setup: Smart contract automatically splits fees between curator and distributor based on pre-defined terms.

Requirements:- Dedicated new vault (V1 or V2) for the partnership

- Splitter contract receives fee recipient role

- Automated distribution of fees to both parties

- Vault accrues performance/management fees

- Fees sent to splitter contract

- Contract automatically distributes per agreement (e.g., 60% curator / 40% distributor, or 50/50)

- Trustless execution

- Transparent onchain tracking

- No manual settlement required

- Requires dedicated vault (curator unlikely to share existing vault)

- Additional smart contract complexity

- Gas costs for splitting operations

Use Case: Best for formal partnerships requiring trustless, transparent revenue sharing with onchain guarantees.