Curate Markets & Liquidity (Vaults V1)

As a curator for a Morpho Vault V1, your primary responsibilities are to manage which markets the vault can supply to, set risk limits via supply caps, and organize the flow of capital using supply and withdraw queues.

This guide provides a comprehensive overview of how to perform these actions using two methods:

- The Curator App: A user-friendly interface for most management tasks.

- Direct Contract Calls: For advanced users or scripted interactions via Etherscan.

Curating Supply Caps

Supply caps are the primary tool for controlling a vault's risk exposure to any single Morpho Market.

Using the Curator App

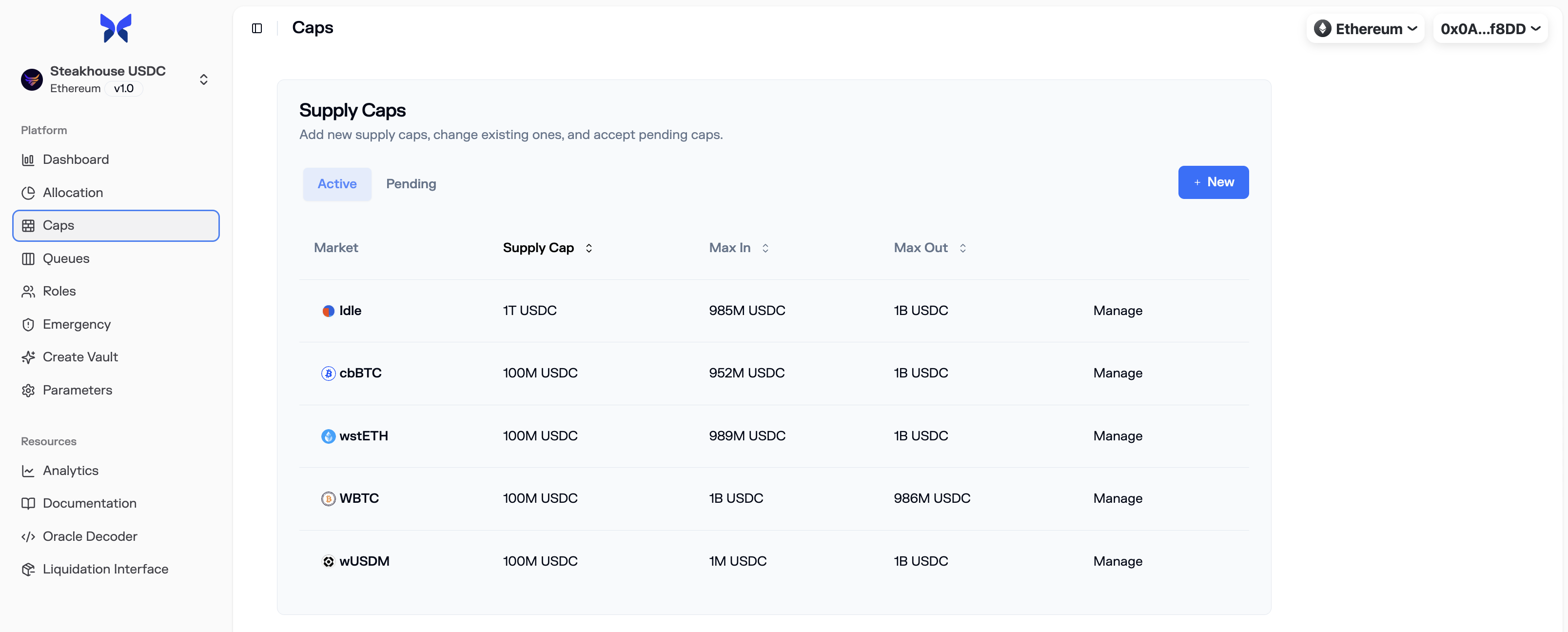

Navigate to the Caps tab in the Curator App to view and manage all active and pending market caps.

Modifying or Adding a New Cap

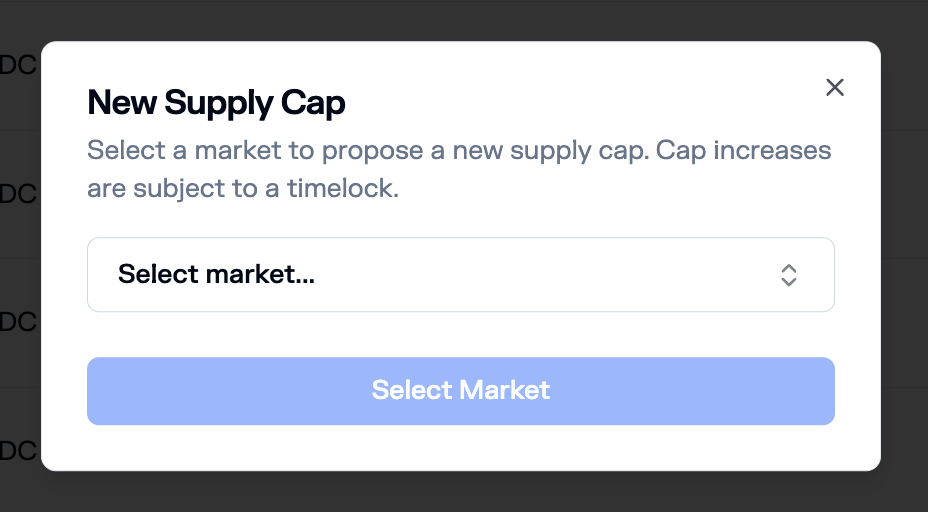

Click "+ New" Button

Click the "+ New" button in the top right to open the market selection modal.

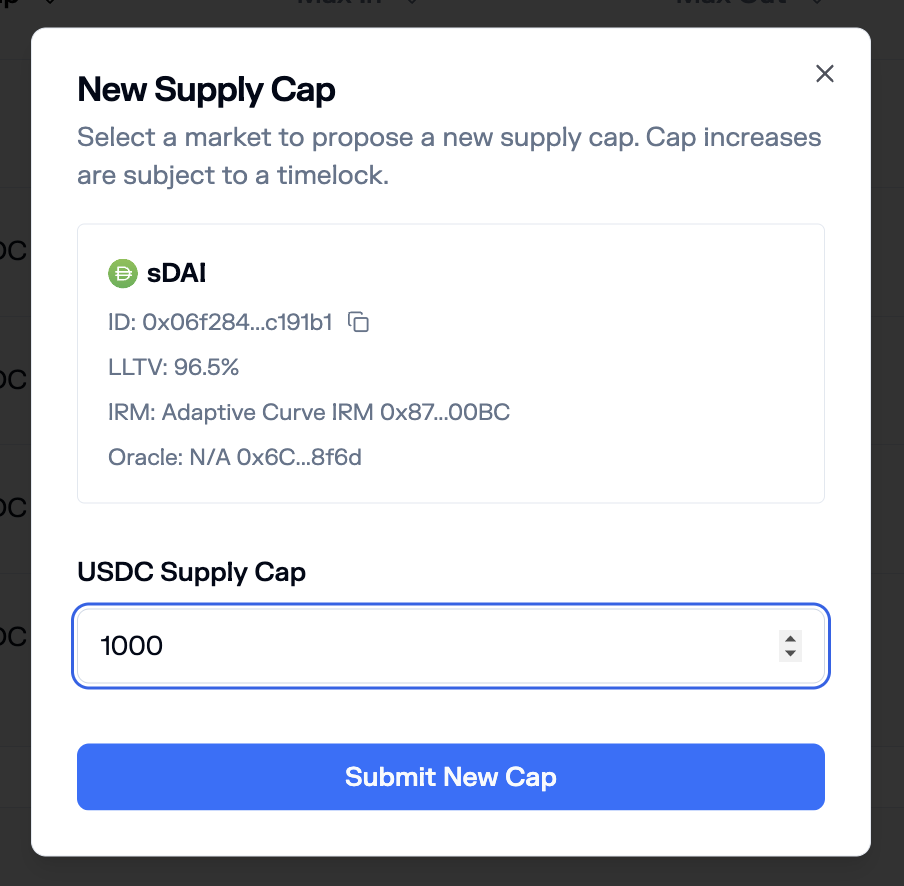

Select a Market and Set the Cap

Choose the market you want to enable or modify. Set the desired Supply Cap value and click Submit New Cap. Setting a non-zero cap for the first time will enable the market in your vault.

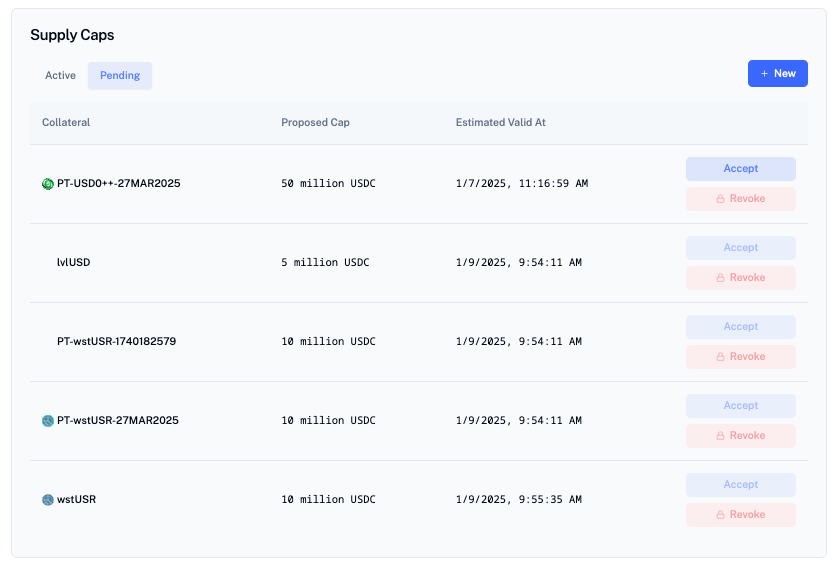

Wait for the Timelock and Accept

Increasing a cap is a timelocked action. After submitting, the proposal will appear in the Pending tab. Once the timelock expires (shown under "Estimated Valid At"), you must click Accept to finalize the change. Decreasing a cap is instant.

Using Direct Contract Calls

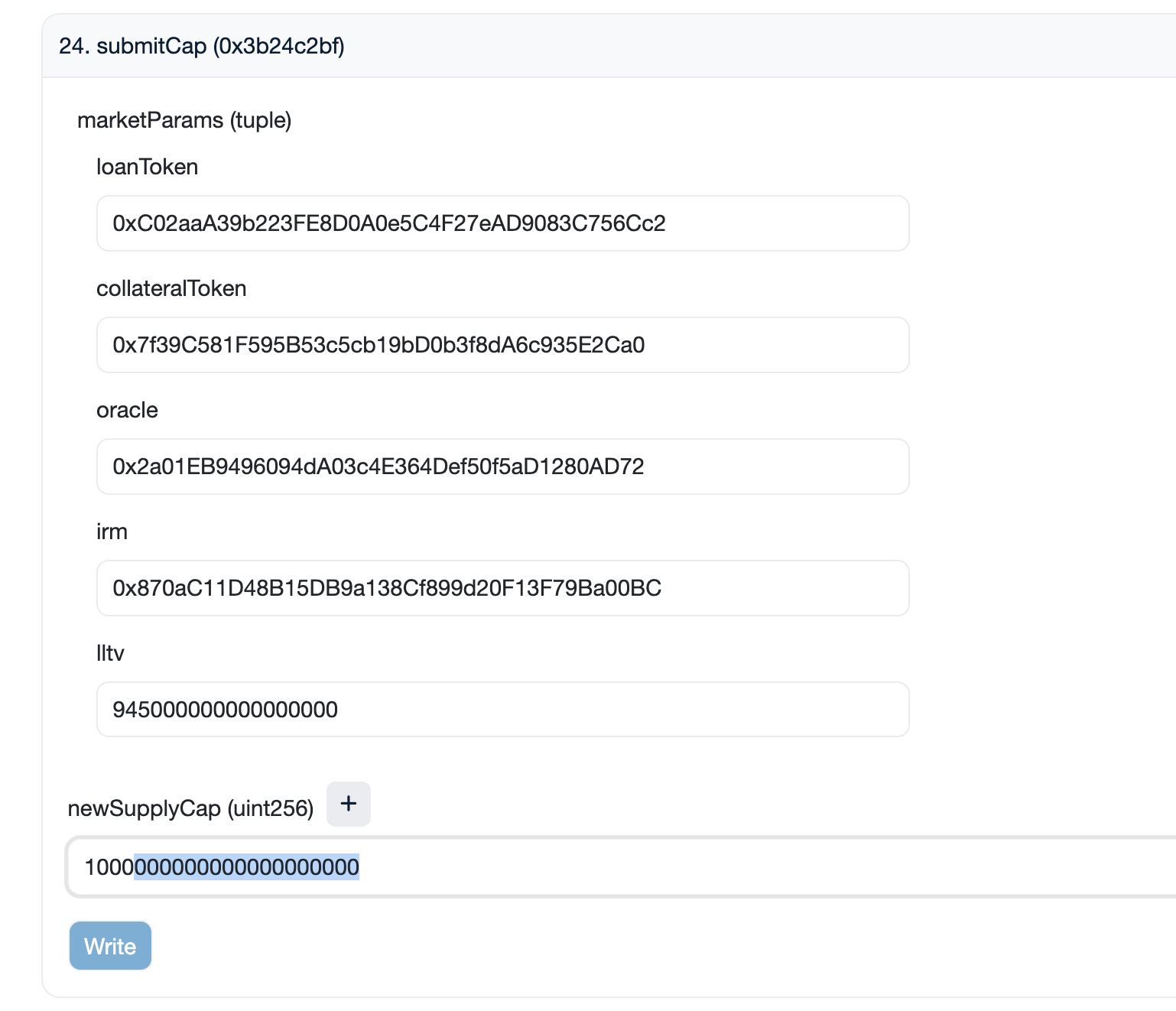

1. Submit the Cap (submitCap)

Execute submitCap with the market's parameters and the desired cap amount. The newSupplyCap should be in the native decimals of the loan token.

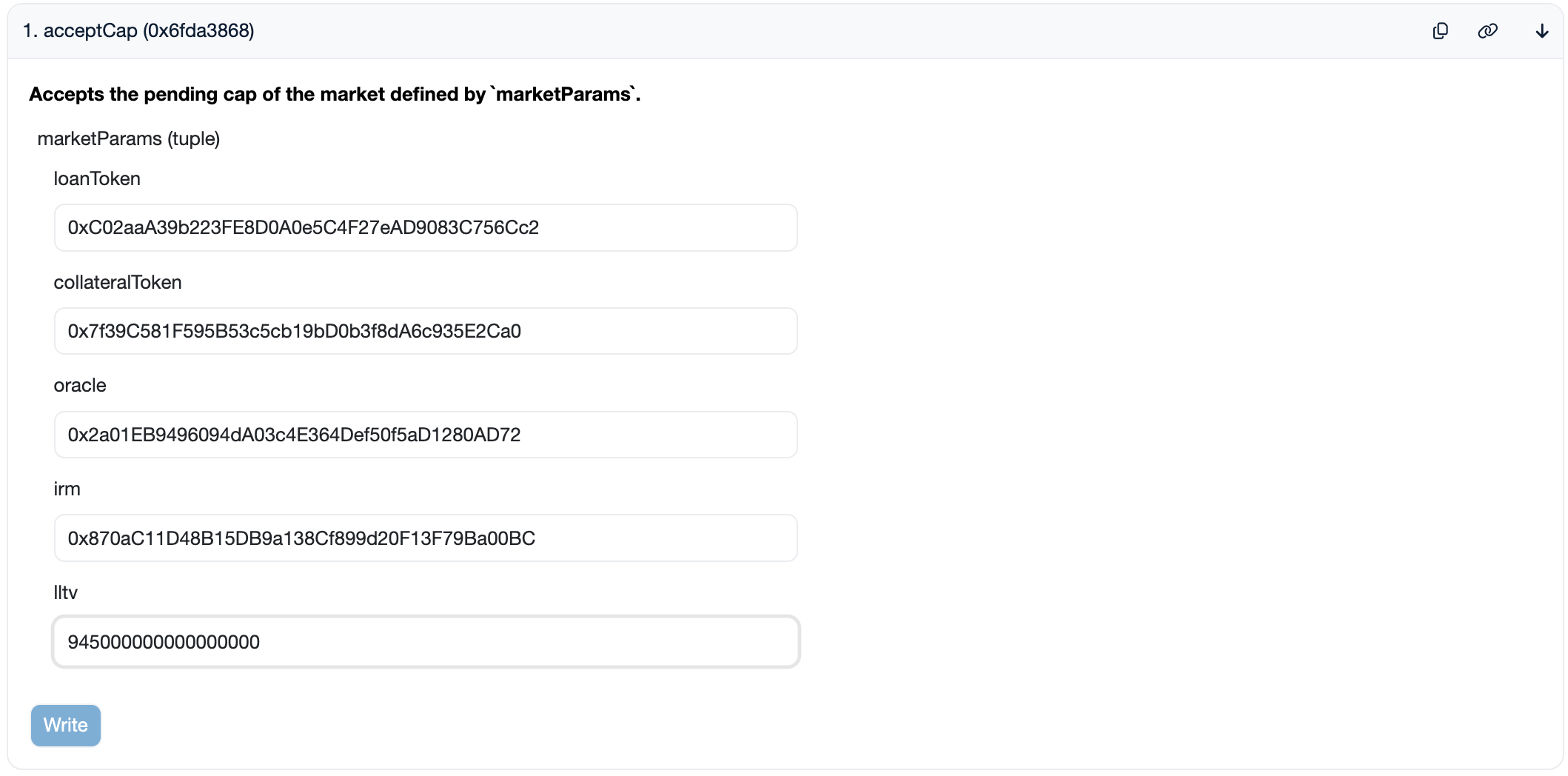

2. Accept the Cap (acceptCap)

After the timelock period expires, anyone can call acceptCap with the same market parameters to finalize the change.

Managing Queues

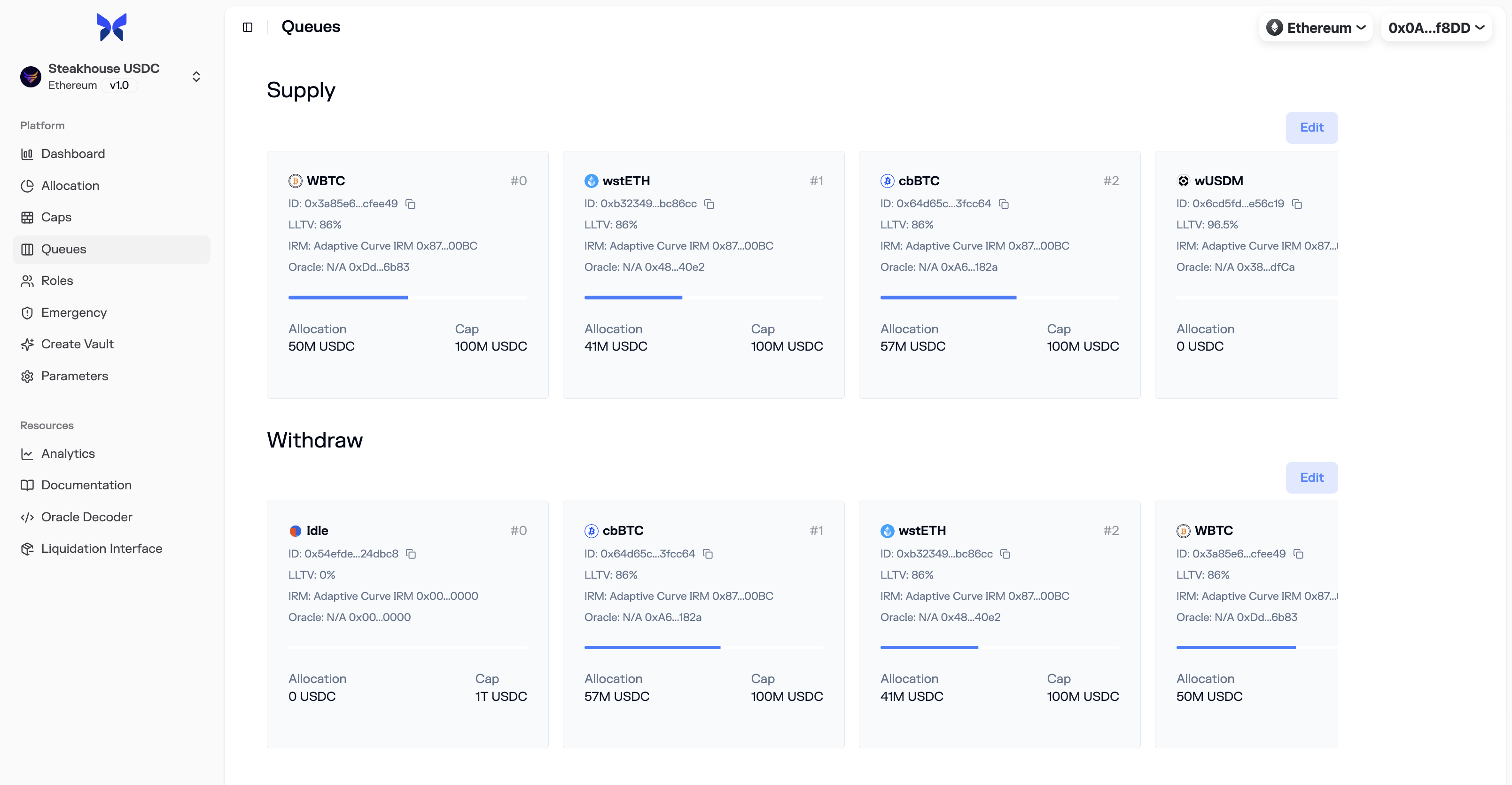

The Supply and Withdraw Queues dictate the logic for capital allocation. The Allocator role is responsible for their management.

Using the Curator App

Navigate to the Queues section to view and manage your vault's queues.

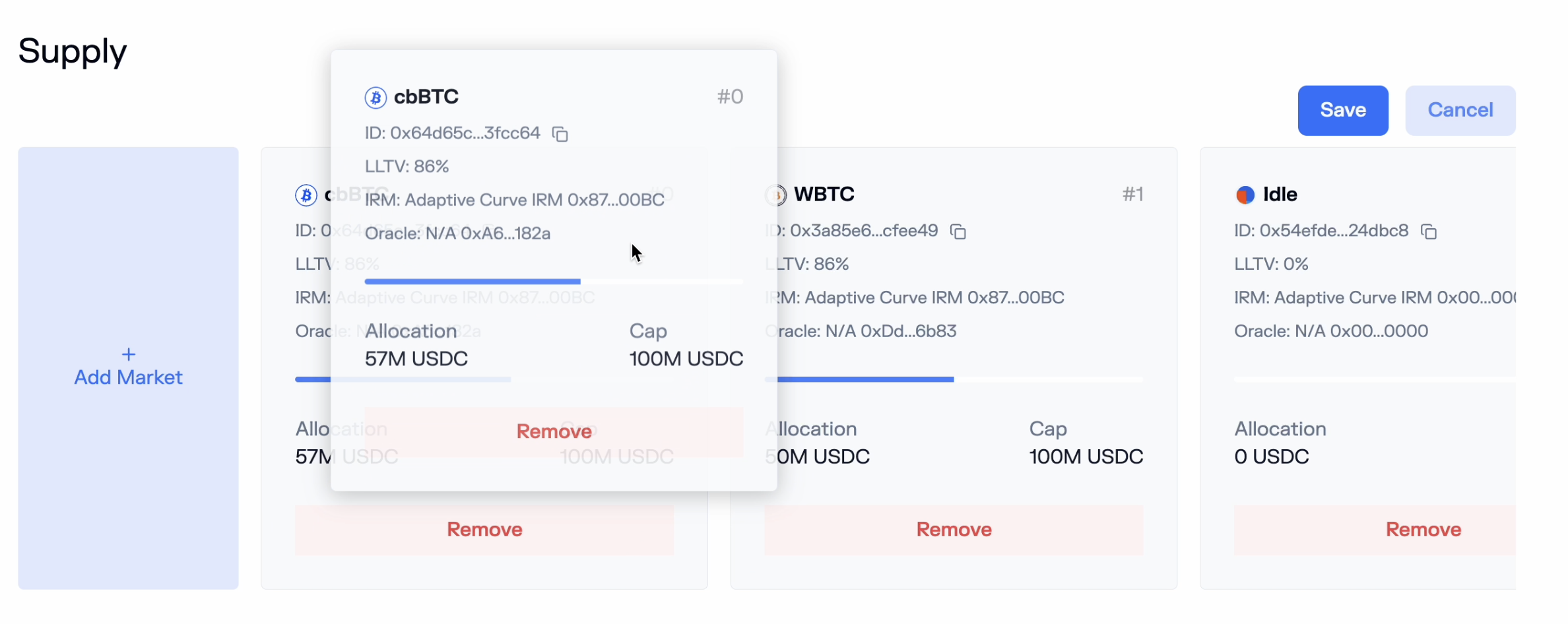

Reordering a Queue

- Click the Edit button for the queue you wish to modify.

- Drag and drop the market cards into your desired order.

- Click Save and confirm the transaction.

Using Direct Contract Calls

Setting the Supply Queue (setSupplyQueue)

To set the supply queue, call setSupplyQueue with an array of market Ids in the desired order.

# Example input for setSupplyQueue

[0xc54d7acf14de29e0e5527cabd7a576506870346a78a11a6762e2cca66322ec41, 0x_MARKET_ID_2, ...]Updating the Withdraw Queue (updateWithdrawQueue)

To reorder the withdraw queue, call updateWithdrawQueue with an array of numbers representing the original indexes of the markets in their new desired order.

For example, if the original queue was [MarketA, MarketB, MarketC] (indexes [0, 1, 2]) and you want the new order to be [MarketC, MarketA, MarketB], you would call updateWithdrawQueue([2, 0, 1]).

Delisting a Market

Delisting a market is a multi-step process to ensure funds are safely migrated.

Standard Delisting Process

This process safely removes a market without losing funds.

1. Set Market Cap to Zero

Instantly set the market's supply cap to 0 using submitCap. This prevents new allocations to the market.

2. Reallocate All Liquidity

Use reallocate to move all of the vault's assets out of the target market and into other active markets. Ensure the market to be delisted is not included in the reallocate call.

3. Update the Withdraw Queue

Once the market's cap and the vault's allocation are both zero, call updateWithdrawQueue with a new index array that omits the delisted market.

Dust Shares Removal

There is an edge case to consider when removing a market. A small amount of dust supply shares could accumulate through usual allocation processes. Reallocating out of these markets via reallocate is not possible because the reallocation is denominated in assets, while the removal of a market from the withdraw queue requires supply shares to be zero. When you have some dust shares on a market that you are trying to remove, you are forced to supply one unit of an asset on behalf of your vault to then be able to reallocate and withdraw. For example for USDC it would be 0.000001$ (6 decimals).

Warning: You must not force remove a market if this edge case occurs:

- in V1.0 force-removing it makes share price goes down instantly and will go up instantly if you re-enable the market.

- in V1.1, force-removing it creates a bad debt in the vault instantly and will not go away if you re-enable it (instead, the share price will go up, but the same hole will be present).

Remove dust shares via the Curator App V1 (Ethereum mainnet and Base only)

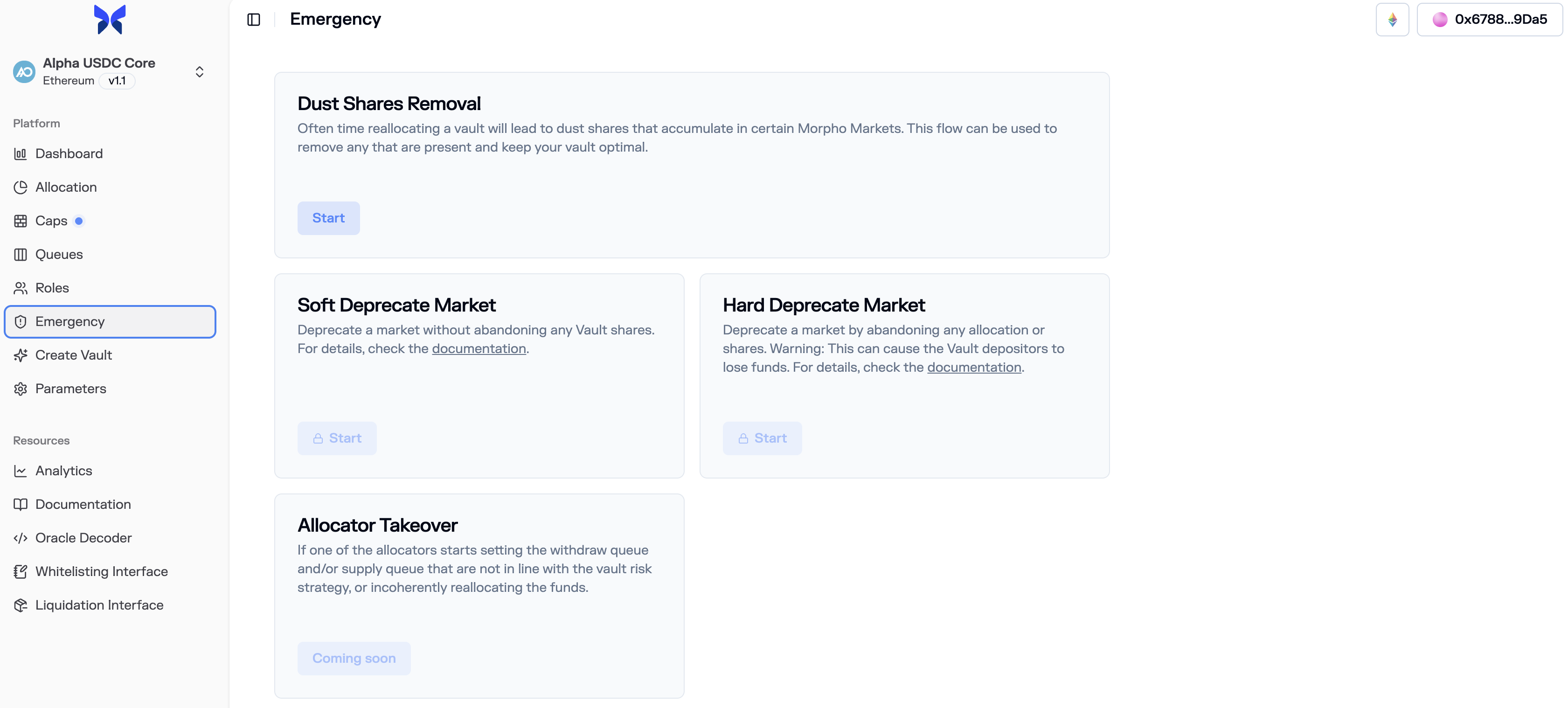

1. Head to the Emergency page

Click on the "Dust Shares Removal" start button.

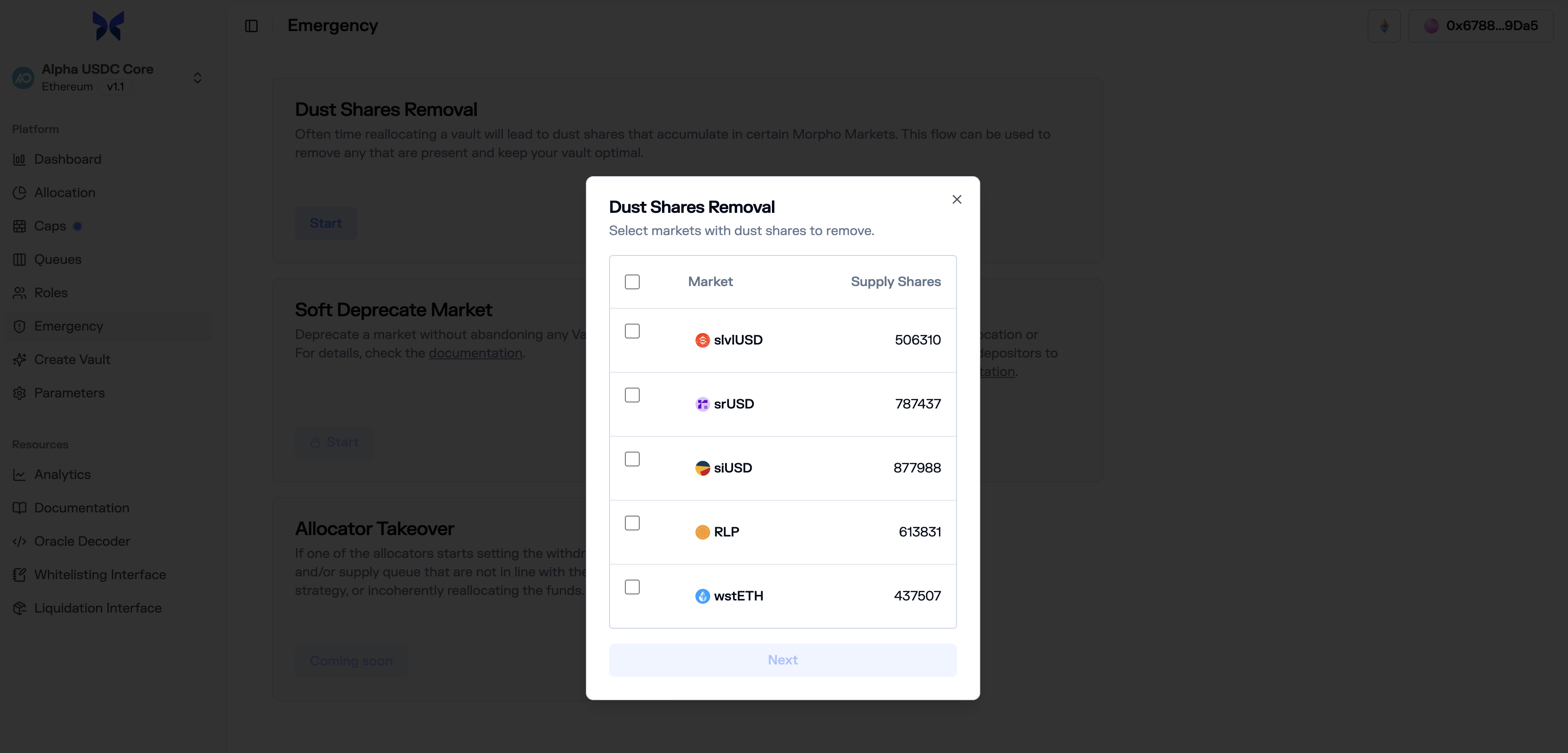

2. Choose the targeted market

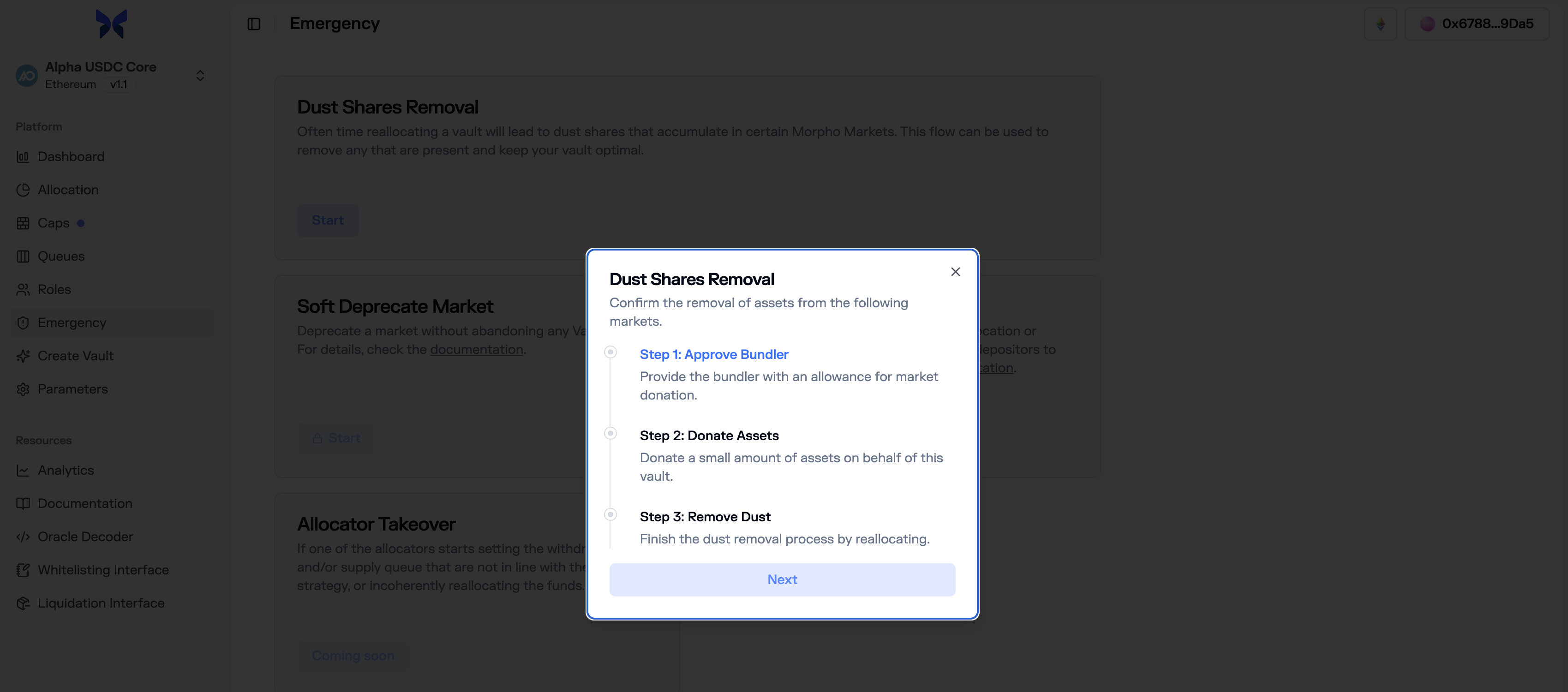

3. Follow the app

The flow will require to:

- Approve the Bundler V2

- Donate 1 unit of the asset on behalf of the vault

- Remove dust by reallocating

Remove dust shares using direct contract calls

For other chains than Ethereum and Base, you will have to follow the same steps as described above but interactign at contract directly (via script or explorer).

1. Approve the Morpho contract and supply 1 unit of asset in the market on behalf of the vault.

See contract spec of the supply function here.

2. You can then reallocate liquidity out of the market

See how to interact at contract level here

Emergency Market Removal

This process should only be used if a market is malfunctioning and funds cannot be safely reallocated.

1. Submit Market for Removal

As the Curator, call submitMarketRemoval with the parameters of the market to be force-removed.

2. Wait for the Timelock

A timelock period begins, allowing users to react.

3. Update the Withdraw Queue

After the timelock expires, the Allocator can call updateWithdrawQueue to remove the market, even if it still contains vault assets.

Delisting Process Summary

For safe market delisting:

- Remove the market from the supply queue

- Reduce the market cap to zero

- Reallocate all funds from the market to other markets

- Remove the market from the withdraw queue

For emergency situations:

- Submit market removal

- Wait for timelock to elapse

- Update the withdraw queue

Always prioritize the safety of depositor funds and provide clear communication throughout the delisting process.